Improved Cost Outlook Bodes Well for Goldcorp’s Future

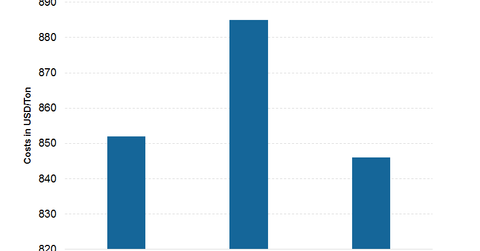

Goldcorp reported a strong reduction in all-in sustaining costs (or AISC) for 2Q15. AISC came in at $846 per ounce, compared with $885 per ounce in 1Q15 and $852 in 2Q14.

Aug. 11 2015, Updated 9:06 a.m. ET

Cost reduction

Goldcorp (GG) reported a strong reduction in all-in sustaining costs (or AISC) for 2Q15. AISC came in at $846 per ounce, compared with $885 per ounce in 1Q15 and $852 in 2Q14. Total cash costs on a co-product basis were $656 per ounce, compared with $643 per ounce in 2Q14. The main driver behind lower costs was the higher sales volume as discussed above.

The Peñasquito mine reported AISC costs of $416 per ounce. The Musselwhite, Cerro Negro, and Pueblo Viejo mines reported costs lower than the company’s average.

Higher sales volume and lower costs led Goldcorp to report a positive free cash flow for the quarter. The company reported a free cash flow of $174 million, or $50 million after the payment of dividends.

Improved cost outlook

Goldcorp also reduced the AISC guidance for 2015 to $850–$900 per ounce from $875–$950 per ounce. This is most likely due to increased production in the second half of the year, including higher grades at the mines currently ramping up.

Newmont Mining (NEM) also delivered a beat on cost reductions in 2Q15. It reported AISC of $909 per ounce, a reduction of 14.5% year-over-year (or YoY). Kinross Gold (KGC), on the other hand, reported in-line costs at $1,011 per ounce. Agnico–Eagle Mines (AEM) also reported results on July 30, which were slightly above market consensus. AISC came in at $864 for 2Q15.

The VanEck Vectors Gold Miners ETF (GDX) has 7.2% exposure to Goldcorp, its largest holding. The SPDR Gold Shares ETF (GLD) gives exposure to spot gold prices.

Gold miners can’t just be content with reducing costs and increasing production in this weak gold price environment with a weaker gold price outlook. We’ll see in our next part what other steps is Goldcorp taking to brace itself for the challenging environment ahead.