Current Gold Prices Push Barrick Gold to Go for a Leaner Look

Barrick Gold (ABX) is focused on reducing operating expenses. The company’s all-in sustaining costs to produce gold in 2Q15 totaled $895 per ounce. In 1Q15, costs came in at $927 per ounce.

Aug. 23 2015, Updated 4:15 p.m. ET

Reducing operating expenses

Barrick Gold (ABX) is focused on reducing operating expenses. The company’s AISC (all-in sustaining costs) to produce gold in 2Q15 totaled $895 per ounce. In 1Q15, AISC came in at $927 per ounce. Management had previously indicated that the second quarter would be the highest cost quarter in 2015 due to the timing of sustaining capital expenditures. But the second quarter turned out to be better than expected.

Goldcorp’s (GG) AISC came in at $846 per ounce in 2Q15, an improvement over $885 per ounce in 1Q15. Kinross Gold (KGC), on the other hand, reported costs of $1,011 per ounce. Agnico Eagle Mines’ (AEM) AISC came in at $864 in 2Q15.

Multipronged approach

Barrick plans to take a multipronged approach toward reducing its cash costs. First, the company plans to change mining methods, optimize maintenance, and improve its supply chain to achieve productivity-related gains from its operations. Different mining methods are to be used at Hemlo and Cortez underground operations.

Second, to reduce costs related to energy and consumables, management says that it has already identified $60 million in savings. Explosive costs will be cut over a five-year period. The company is also planning to reduce fuel costs by substituting with cheaper LNG (liquefied natural gas) or renewable energy such as solar power. These conversions would result both in lower costs and environmental benefits.

Last, the firm will reduce working capital by reducing stockpiles and increasing turnover for inventory.

Improving cost profile

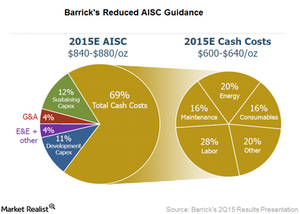

The above-mentioned efforts will provide much-needed help to the company to reduce its unit costs. Barrick guided for 10% lower unit costs in the second half of 2015 as compared to the first half. Guidance fell from $860 to $895 per ounce to $840 to $880 per ounce.

The important point to note about Barrick’s portfolio optimization is that its asset sales are reducing production, so its per unit costs are declining instead of increasing. The firm is disposing of non-core assets that cost more to operate. This should position it as a leaner organization. And given the current weak gold price environment, being leaner should help it take advantage of the market when prices start to improve.

The VanEck Vectors Gold Miners ETF (GDX) offers exposure to senior and intermediate gold miners. The SPDR Gold Trust (GLD) tracks spot gold prices.