What Are the Risks for Bristol-Myers Squibb?

Bristol-Myers Squibb deals with innovative products, and any failure to secure or protect intellectual property rights is a huge risk and may lead to huge losses.

July 10 2015, Updated 11:05 a.m. ET

Risks

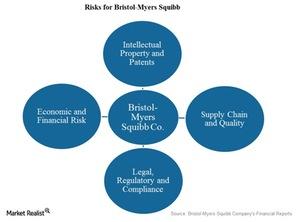

Bristol-Myers Squibb Company (BMY) faces the following risks in addition to industry-specific risks of the pharmaceutical industry.

Intellectual property or patents

Bristol-Myers Squibb deals with innovative products, and any failure to secure or protect intellectual property rights may lead to huge losses. Obtaining necessary patents and proprietary rights for its products is extremely critical for business strategy, profitability, and implied success of a product. There’s a risk of losing market exclusivity earlier than expected or losing market share to generics when a patent expires or when biosimilars are introduced as competing products.

Supply chain and quality of products

Product supply and related patient access can be negatively impacted by disruption in supply chain continuity. Below are some of the many factors that can disrupt this continuity.

- product seizures, recalls, or forced closings of manufacturing plants

- failure to comply with current good manufacturing practice (or GMP) requirements in commercial manufacturing through the distribution chain, the company, its contractors, or its suppliers

- inadequate controls and governance of quality as well as other factors that could delay the launch of new products

- shortages in supply of current products

- potential damage to brand reputation

All these attract regulatory, legal, and financial consequences that could materially and adversely affect the reputation and financial performance of the company.

Legal, regulatory, and compliance

Bristol-Myers Squibb makes it a priority to comply with all laws, rules, and regulations. Any failure to comply may result in civil or criminal legal proceedings and regulatory sanctions. These proceedings not only cost the company monetarily but also affect its brand name.

Economic and financial risks

Bristol-Myers Squibb operates worldwide and is subjected to political, socioeconomic, and financial factors globally and in individual countries. The company is facing the adverse impact of a sustained economic downturn.

Fluctuations in foreign exchange rates and limited third-party insurance coverage are also added financial risks. Third-party royalties also account for a significant part of the company’s income.

Other pharmaceutical companies such as Merck & Co. (MRK), Pfizer (PFE), and Sanofi (SNY) face similar risks. The Health Care Select Sector SPDR ETF (XLV) is focused on large pharmaceutical and healthcare companies.