What Is the Rationale for the ACE–Chubb Merger?

The biggest rationale for the ACE–Chubb merger is the potential for cost-cutting. By combining with Chubb, ACE Limited is creating a leading player in property and casualty insurance.

July 15 2015, Published 1:49 p.m. ET

Low growth in the P&C insurance space

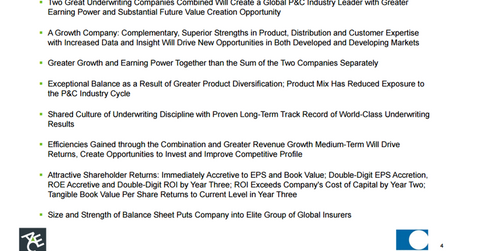

Insurance companies have found themselves in a slow growth environment, as competition makes it difficult to raise prices. In fact, the biggest rationale for the ACE–Chubb merger is the potential for cost-cutting. By combining with Chubb (CB), ACE Limited (ACE) is creating a leading player in property and casualty insurance. The transaction will make the combined company more diversified as well and will hopefully subdue the sometimes volatile property and casualty insurance cycle.

Chubb is primarily a US domestic player, while ACE is more international. By the time the deal closes, the domestic/international split will be about 50/50. The pro-forma company will be 60% commercial insurance, 21% personal lines, 17% accident and health, and 3% reinsurance.

Synergies

The transaction will be accretive to EPS and book value immediately, but it will be dilutive to tangible book value. It is expected to be accretive to EPS by over 10% starting in the third year after the deal closes. The transaction is expected to generate $650 million annually of cost savings by 2018.

Given the complementary product offerings, the deal will provide cross-selling opportunities as well. Chubb is stronger in the middle market, while ACE Limited is stronger in the upper market and large accounts.

Merger arbitrage

Other important merger spreads include the merger between Freescale Semiconductor (FSL) and NXP Semiconductor (NXPI), as well as the deal between Baker Hughes (BHI) and Halliburton (HAL). For a primer on risk arbitrage investing, please refer to Merger arbitrage must-knows: A key guide for investors.

Investors who would like to trade in the financial sector can look at the S&P SPDR Financial ETF (XLF).