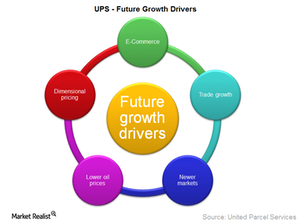

Possible Key Growth Drivers for UPS in the Near Future

The e-commerce industry is poised to grow rapidly in the future. With this growth will come the need for package delivery.

July 23 2015, Updated 10:05 a.m. ET

Introducing dimensional pricing

Similar to rival FedEx (FDX), United Parcel Service (UPS) has introduced a dimensional pricing method for its smaller packages. This method charges for packages according to their dimensions as well as weight. This should help the company get higher profits from its lighter packages and enable it to use its carrier space more efficiently.

For details on dimensional weight pricing, read FedEx’s New Pricing Policy Improves Its Efficiency.

Shift in customer choices

Customers today are relatively less brand loyal and thus prefer cheaper, less time-sensitive deliveries over faster, more expensive options, provided they meet acceptable service quality levels. This has led to a fall in express delivery system income levels. UPS needs to identify the customer’s choices and fulfill them in order to maintain profitability.

Changing end markets

With a change in customer preferences, UPS is also focused on changing its end markets. The company has increased its focus on catering to the growing business-to-consumer or e-commerce–based package deliveries. The e-commerce industry is poised to grow rapidly in the future. With this growth will come the need for package delivery.

Expanding network

UPS already has a very wide, strong network. It has many distribution points around the world and an extremely organized chain to deliver goods quickly and safely. The company can make better use of its air and ground services to reach newer locations.

Lower oil prices

The fall in oil prices has helped lower UPS’s expenses. As long as oil prices remain subdued, the company will deliver better results.

International trade growth opportunities

The volume of international trade is expected to grow in the next couple of years. This will present UPS with ample opportunities to grow its value. The company has estimated a 9%–13% growth in the long run, which should prove beneficial to the company.

UPS forms the largest holding of 7.6% in the iShares Transportation Average ETF (IYT). Similar companies included in the ETF are FedEx (FDX), Expeditors International (EXPD), and Con-way (CNW), with 13.14%, 4.19%, and 3.19% holdings, respectively.