Fundamental Market Demand Rose for 4-Week Treasury Bills Auction

The US Department of the Treasury conducted the weekly auction of four-week Treasury bills (or T-bills) on April 26.

May 2 2016, Published 2:48 p.m. ET

Four-week Treasury bills auction

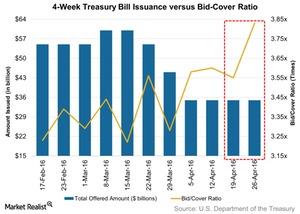

The US Department of the Treasury conducted the weekly auction of four-week Treasury bills (or T-bills) on April 26. The issuance was $35 billion, the same as in the previous week. The Treasury department has maintained the borrowing amount for the fourth consecutive week.

Overall demand surged

The bid-to-cover ratio for these bills, depicting overall demand, rose from 3.6x to 3.8x week-over-week. The year-to-date coverage of the one-month T-bills auction has averaged 3.5x so far in 2016.

The high discount rate for the April 26 auction came in at 0.19%, the highest in April 2016. In the previous week, high discount rates came in at 0.18%.

Market demand skyrocketed

Market demand for the four-week Treasury bills rocketed from the previous week. It rose from 29.1% in the previous week to 43.1% last week, the highest in April 2016.

The percentage of accepted indirect bids rose from 24.3% to 37.3% week-over-week. Indirect bids include bids from the foreign government.

Domestic investors’ interest in the auction nudged up from the previous week as the percentage of direct bids were up from 4.8% to 5.8% week-over-week. Direct bids include domestic money managers like BlackRock (BLK) and Wells Fargo (WFC).

The share of primary dealers fell from 70.9% in the previous week to 56.9% last week. Primary dealers are a group of 22 broker-dealers authorized by the Fed. They’re obligated to bid at US Treasury auctions and take up the excess supply. They include firms like J.P. Morgan (JPM) and Morgan Stanley (MS).

Investment impact

The MassMutual Select Strategic Bond Fund – Class A (MSBAX) was up 0.5% week-over-week while the J Hancock Government Income Fund – Class A (JHGIX) rose 0.4% last week. Meanwhile, the iShares Short Treasury Bond Fund (SHV) was flat last week.

For more mutual fund trends and analysis, please visit Market Realist’s Mutual Fund page.