iShares Short Treasury Bond

Latest iShares Short Treasury Bond News and Updates

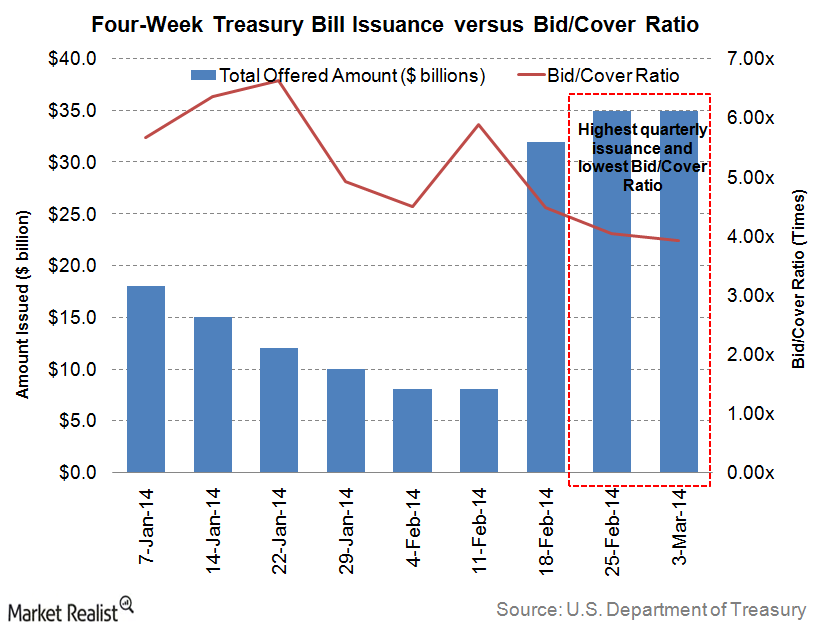

The demand for 4-week Treasury bills remained subdued last week

A considerable amount of $35 billion was offered for the weekly four-week T-bills auctioned on Tuesday, March 4, 2014.

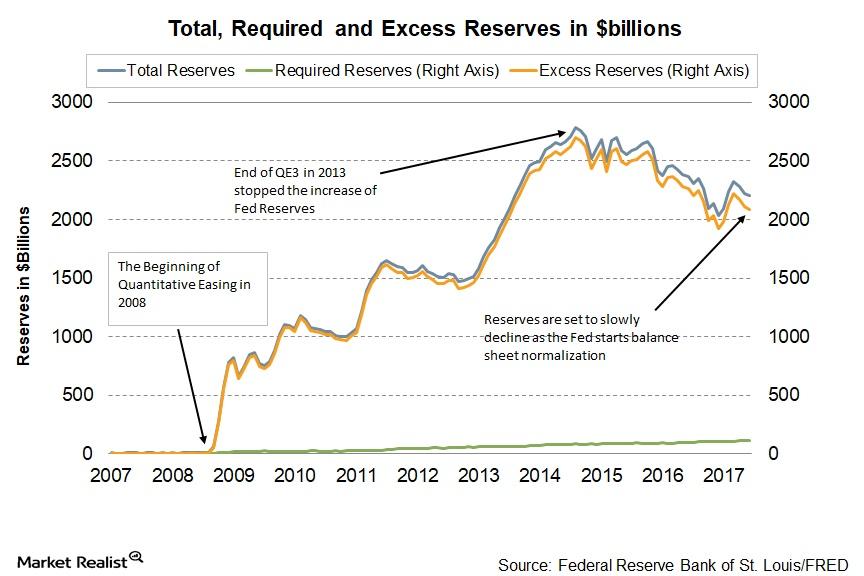

Why the Fed Has Initiated Balance Sheet Normalization

Atlanta Federal Reserve president and CEO, Raphael Bostic, recently spoke at a conference about the Fed’s balance sheet normalization program.

Bill Gross Reviewed Close Calls That Dotted a ‘Magnificent Era’

In his monthly investment outlook for June 2016, Bill Gross outlined that money managers who have decades of experience witnessed a “magnificent era.”

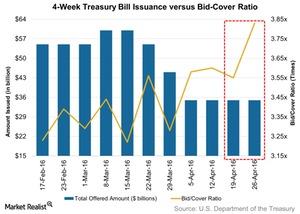

Fundamental Market Demand Rose for 4-Week Treasury Bills Auction

The US Department of the Treasury conducted the weekly auction of four-week Treasury bills (or T-bills) on April 26.