Foreign Exchange Impacts Novartis’s Growth in 2Q17

In its earnings release on July 8, 2017, Novartis (NVS) reported flat revenues at constant currencies for 2Q17.

July 24 2017, Updated 1:05 p.m. ET

Novartis’s revenues

In its earnings release on July 8, 2017, Novartis (NVS) reported flat revenues at constant currencies for 2Q17. Revenues fell due to a 2.0% negative impact of foreign exchange. The company missed analyst estimates of $12.27 billion, reporting revenues of $12.24 billion for 2Q17.

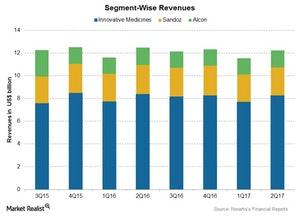

The above graph shows Novartis’s revenues in each quarter for the last two years. More than 55.0% of its revenues are reported from sales outside the United States, so growth was affected by the negative impact of foreign exchange.

Revenues by segment

Novartis has restructured its business segments over the last few years. Below are the segment performances for 2Q17:

- Innovative Medicines, formerly the Pharmaceuticals segment, includes two business units: Novartis Pharmaceuticals and Novartis Oncology. The segment reported a marginal fall in revenues to $8.27 billion in 2Q17 compared to $8.39 billion in 2Q16. That included a ~1.0% operational growth, which was more than offset by a ~2.0% negative impact of foreign exchange. Ophthalmic pharmaceutical products such as Patanol that were transferred to Innovative Medicines have reported lower sales due to generic competition.

- Sandoz, the generic pharmaceuticals segment, reported a 5.0% fall in revenues at $2.45 billion for 2Q17 compared to $2.58 billion in 2Q16. The segment had an operational fall of 4.0% and a 1.0% negative impact of foreign exchange.

- Alcon, the eye care segment, reported a 1.0% rise in 2Q17 revenues, including a ~3.0% growth in revenues at the operational level and a ~2.0% negative impact of foreign exchange. This segment reported revenues of $1.52 billion in 2Q17 compared to $1.51 billion in 2Q16.

To divest the risk, you can consider the VanEck Vectors Pharmaceutical ETF (PPH), which holds ~6.3% of its total assets in Novartis. PPH also holds 5.0% in Novo Nordisk (NVO), 5.0% in Merck & Co. (MRK), and 4.9% in AstraZeneca (AZN).