The Seemingly Never-Ending Greek Debt Saga at a Tipping Point

The seemingly never-ending Greek debt (GREK) saga continues to play out, complete with twists, turns, and obstacles à la typical potboiler.

June 29 2015, Published 1:24 p.m. ET

It’s hard to miss the many headlines coming out of Europe lately. Heidi Richardson explains why, though much of the region’s news may support the case for Eurozone equities, a wait-and-watch approach may be the best option for the Eurozone while Greece plays spoilsport.

It’s hard to miss the many headlines coming out of Europe lately, on news ranging from the latest in Greece’s debt saga to the details of ongoing European Central Bank (or ECB) stimulus.

So, it’s no surprise that I get a lot of questions about what these recent events mean for my outlook of the region. My general answer: Much of the region’s news helps support my view that eurozone equities, and stocks in Germany (EWG) in particular, not only look fundamentally attractive but look good on the basis of relative valuation. However, Greece continues to be a cause of worry. Here’s why, in a closer look at the questions I frequently get asked and how I respond.

Market Realist:

The seemingly never-ending Greek debt (GREK) saga continues to play out, complete with twists, turns, and obstacles à la typical potboiler. Greece remains on the brink of financial disaster despite incessant negotiations that have made headlines since the start of this year.

Yet, the endgame seems to be approaching, finally, as IMF (International Monetary Fund) debt worth 1.6 billion euro comes due on Tuesday. Without a deal that would see its creditors—namely the European Commission, the European Central Bank and the International Monetary Fund—release more loan funds, Greece is likely to default on the payment.

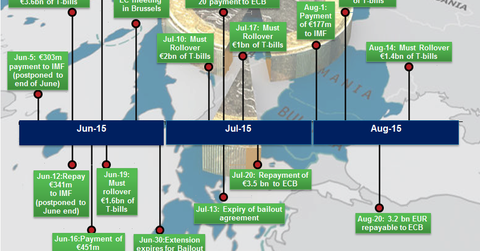

The graph above presents a timeline of requirements that the beleaguered nation must meet if it wants to avoid the point of no return with its Eurozone creditors (EZU).

Acrimony and discord reigned over the latest European (FEZ) (IEV) meeting in Brussels, as opposing sides failed to see eye to eye on the cash-for-reforms proposals.

Meanwhile, Greek depositors have continued to withdraw cash from their banks, bringing them to the edge of insolvency. According to JPMorgan Chase analysts, 6 billion euros seeped out of banks last week alone. Total deposit outflows now amount to 44 billion euros this year. The graph above shows how deposit reserves in Greek banks have dwindled over the past few months while emergency liquidity assistance from the ECB (European Central Bank) has been steadily increasing.

The financial system in Greece relies heavily on ECB funding for its very survival. This funding lifeline got cut off by the ECB when talks broke down over the weekend. Capital controls have now been implemented and Greek banks have been shut down until July 6.