What Are the Key Categories in the US Tea Industry?

Data from the Tea Association of the USA estimates that the wholesale value of the US tea industry grew by 4.1% to reach $10.8 billion in 2014.

June 4 2015, Published 4:10 p.m. ET

US tea industry

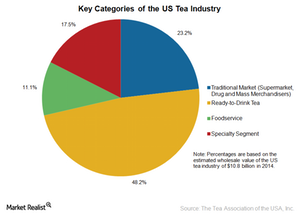

Data from the Tea Association of the USA estimates that the wholesale value of the US tea industry grew by 4.1% to reach $10.8 billion in 2014. The key categories of the US tea segment are:

- ready-to-drink tea

- traditional market, which includes supermarkets, drug stores, and mass merchandisers

- foodservice

- specialty segment

Dominant category: ready-to-drink tea

As indicated in the above chart, based on the data provided by the USTA, the ready-to-drink category is the US tea industry’s largest segment, accounting for about 48.2%, or $5.2 billion, of the total wholesale value. The traditional segment is the second-largest segment with an estimated value of $2.5 billion in 2014. The specialty tea segment accounted for 17.5%, or $1.9 billion, of the estimated wholesale value, while the foodservice segment accounted for 11.1%, or $1.2 billion, of the estimated wholesale value of the tea industry in 2014.

Popular tea varieties

Americans consumed over 80 billion servings of tea, or more than 3.6 billion gallons in 2014. Iced tea is the preferred choice in the US, and it accounted for ~85% of the tea consumed. In terms of tea varieties, about 84% of the tea consumed in the US was black tea, 15% was green tea, and the remaining portion included oolong, white, and dark tea. Though all these varieties of teas come from the same plant, the difference lies in the degree of processing and the oxidization level.

Some popular tea brands include Starbucks’ (SBUX) Teavana brand, Coca-Cola’s (KO) Fuze and Gold Peak brands, the Snapple brand portfolio owned by Dr Pepper Snapple (DPS), and PepsiCo (PEP) and Unilever’s (UL) Pure Leaf brand.

Unilever makes up ~0.2% of the Vanguard FTSE All-World ex-US ETF (VEU).