Rising Interest Rates, Banks, and Insurance Companies

Banking stocks are expected to benefit from higher interest rates, but not immediately. Also, rising interest rates would be countered by higher existing liquidity.

Dec. 16 2015, Updated 9:59 a.m. ET

The rate hike and banks

The US Fed is targeting a series of interest rate hikes in 2016. Companies with higher leverage in sectors such as mining, railroads, close-ended funds, steel, cement, and other captive sectors could see a hit on their net profits due to higher interest costs. Banking stocks are expected to benefit from higher interest rates, but that won’t be immediate on rate hikes. Also, rising interest rates would be countered by higher existing liquidity. This could lead to competition on the originations side, and in turn, lead to the holding back of rate hikes for customers.

Investors bought financials stocks like banks, asset managers, and insurance companies on the expectation of higher profits from interest rate hikes. However, the translation of higher rates to profitability can take time and is impacted by various factors.

Insurance companies

Insurance companies could benefit substantially on interest rate hikes, mainly due to higher investment income. Lower interest rates and falling yields on alternative assets led to lower investment income in the recent quarters for insurance companies.

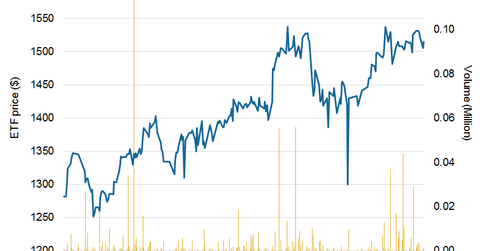

Overall, the industry (KIE) parks a majority of premiums in debt-related instruments that are expected to fetch higher interest on an interest rate hike. As a result, there can be a substantial improvement in their investment incomes. Major companies that would benefit from an interest rate hike include AIG (AIG), Metlife (MET), Allstate (ALL), ACE (ACE), and other major insurance players.