Copper Production in Peru, Chile Falls in First 3 Months of 2015

According to the World Bureau of Metal Statistics, Peru’s refined copper production declined in the first three months of the current year.

June 17 2015, Updated 11:06 a.m. ET

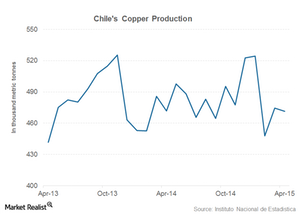

Chile’s copper production

In the previous parts of our series, we explored how copper demand and production are shaping up in China. While China is the world’s largest copper consumer, Latin America (ILF) holds the key to copper supply.

As the largest copper producer and exporter, Chile’s (ECH) copper production data are closely analyzed by analysts. In this part of the series, we’ll discuss the trend in Chile’s April copper production figures.

Production declines

The previous chart shows the trend in Chile’s copper production. The data are released by the National Statistics Institute of Chile. In April, Chile produced 471,000 tonnes of copper—a YoY (year-over-year) decline of 0.5%. In February, Chile’s copper production declined by 1.04%, and again in March, by 2.2%.

So April marks the third consecutive month where Chile’s copper production has declined YoY. Clearly, production has also declined month-over-month. This could be partly due to the floods that hit the country earlier this year.

Southern Copper (SCCO) has mining operations in Chile. In fact, SCCO has the biggest proven copper reserves.

Peru’s copper production

According to the World Bureau of Metal Statistics, Peru’s refined copper production declined in the first three months of the current year. It was down 18% YoY over this period. Peru is the world’s third-biggest copper producer.

In May, Peru faced labor unrest related to changes in the country’s labor law that was passed last year. BHP Billiton (BHP) and Teck Resources (TCK) each have copper mines in Peru.

In the next part of our series, we’ll analyze some recent US economic data.