US Soda Update: Case Volumes Decline for the Tenth Straight Year

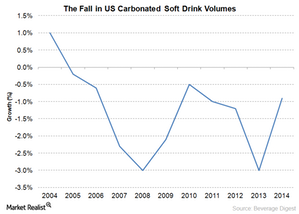

Carbonated soft drink volumes dropped to 8.8 billion 192-ounce cases in 2014. This is the tenth straight year of decline.

Nov. 20 2020, Updated 2:24 p.m. ET

Soda volumes continue to fall

The March 2015 report issued by Beverage Digest indicates a 0.9% decline in US carbonated soft drink case volumes. CSD (carbonated soft drink) volumes dropped to 8.8 billion 192-ounce cases in 2014. This is the tenth straight year of decline in US CSD case volumes.

The CSD category last registered growth—1% case volume growth—in 2004. According to Beverage Digest, CSD volumes were highest in 2004 at 10.2 billion cases, and have now dropped to mid-1990 levels.

Beverage Digest includes energy drinks in its calculation of CSD volumes. Excluding these, case volumes of soda actually declined by 1.2%.

The sluggish demand for soda drinks in developed markets has adversely affected major soft drink producers including Coca-Cola (KO), PepsiCo (PEP), Dr Pepper Snapple (DPS), Cott (COT), and National Beverage (FIZZ).

In 2014, Coca-Cola’s North America Beverage segment’s unit-case volume of sparkling beverages declined by 1%. PepsiCo reported a 2% decline in its North America CSD volumes in 2014. But in Dr Pepper Snapple’s case, branded CSD volumes increased by 1% in 2014.

According to Beverage Digest’s report, Coca-Cola and PepsiCo’s overall CSD case volumes declined by 1.1% and 1.4%, respectively, in 2014, while Dr Pepper Snapple’s case volumes remained flat.

The shift in consumer preferences toward healthier beverages has also affected diet sodas. Diet sodas were introduced to attract calorie-conscious consumers. However, the ill-effects of artificial sweeteners such as aspartame have in fact repelled consumers from the diet variants. For instance, Diet Coke’s case volumes fell by 6.6% in 2014, while the regular Coke brand gained 0.1%.

To revamp its diet brand, PepsiCo announced in April 2015 that it would replace aspartame in diet sodas with two new sweeteners—sucralose and acesulfame potassium. Rival Coca-Cola issued a statement that it has no such plans to change the sweetener in Diet Coke.

Coca-Cola and PepsiCo feature among the top ten portfolio holdings of the Consumer Staples Select Sector SPDR Fund (XLP) and together account for ~13.6% of the ETF. The two beverage giants also make up ~1.6% of the SPDR S&P 500 ETF Trust (SPY).

Case volumes in 1Q15

In 1Q15, Coca-Cola’s North America segment reported a 1% decline in its sparkling beverage unit-case volumes, down from the same quarter the previous year. PepsiCo’s America Beverages segment saw a 2% decline in CSD case volumes. Meanwhile, Dr Pepper Snapple’s CSD volumes grew by 3% in 1Q15. The quarter also saw an increase in pricing by beverage companies.

In response to such sluggish demand for soda, beverage companies are expanding into non-carbonated beverage categories.