IYLD: A Diversified Fixed Income Portfolio

Within fixed income securities, there are two main types of risks: interest rate risk and credit risk.

May 28 2015, Published 2:42 p.m. ET

In order to reach its goals, IYLD invests in some lower-yielding asset classes that may seem a little out of place for a fund that has the word “income” in the title. For example, it has about a 2% allocation to the iShares 20+ Year Treasury Bond ETF (TLT) – currently yielding a rather unimpressive 2.9%.

Market Realist – IYLD is a diversified fixed income portfolio offering decent yields.

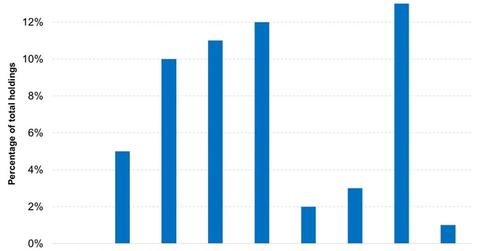

The graph above compares the percentage of holdings across various maturities. IYLD holds both stocks (SPY) and bonds (AGG). Note that the total holdings across maturities do not make up 100%, but only 57% of the total holdings, since common equities do not have maturities.

The graph above somewhat resembles a bullet portfolio. A bullet strategy is one that involves investing in intermediate maturity bonds, but doesn’t invest in bonds with long and short duration, which would be a barbell strategy. Within securities having maturities, the ETF invests only 8.8% in bonds with a maturity of up to three years (SHY). However, IYLD invests 57.9% in securities with maturities between five and ten years (IEF). However, it also invests about 31.6% in bonds with maturities over ten years. While this is not exactly a bullet portfolio, it resembles one.

Read Why barbell bond portfolios can outperform when rates rise to learn how different bond strategies perform under a rising-rate scenario.

Within fixed income securities, there are two main types of risks: interest rate risk and credit risk.

Interest rate risk is the risk of a bond becoming less attractive due to a hike in interest rates. Investing in long-dated bonds, including Treasuries, entails this kind of risk. We discussed the interest rate side of fixed income above.

Credit risk is the risk of the issuer defaulting on either the coupon or the principal payment. This type of risk is mainly seen in high yield bonds (HYG). However, Treasury bonds (TLT) (SHY) do not have such risks, as they are backed by the full faith of the US government.

The graph above shows the breakdown in credit quality of IYLD’s holdings. 62% of its holdings fall under the investment-grade category, while the rest fall under junk status.

IYLD has a good distribution of both interest rate and credit risks. However, it still holds low yield securities like TLT, which we’ll discuss in the next few parts.