The Importance of the Distribution Coverage Ratio

The distribution coverage ratio is the most important ratio for MLPs, as it highlights the cash available to the LP unit holders divided by the cash distributed to LP unit holders.

May 7 2015, Updated 6:33 p.m. ET

An overview of distribution coverage ratios

The distribution coverage ratio is the most important ratio in regards to MLPs, as it highlights the cash available to the LP (limited partner) unit holders divided by the cash distributed to LP unit holders. The higher the ratio for MLPs, the more secure future cash distribution is.

Ideal distribution coverage ratio

Ideally this ratio is supposed to be 1.00 or greater than that. If this ratio is below 1.00, it means that the MLP is distributing more cash than it is making. It also further suggests that the MLP is distributing a portion of cash taken from the debt or equity offering, which is not sustainable in the long run.

Cash from debt or equity is meant for the growth of the MLP. However, there may be a contrasting situation that a MLP is expected to give heavy cash distribution in the upcoming quarter though it currently does not have that much cash. In order to have a stable distribution yield, a MLP can use some portion of cash raised through debt or equity.

It is important to note that a stable distribution is more important as compared to a volatile distribution. MLPs that increase their cash distribution slowly over a period of time tend to be far more stable in terms of operations and asset acquisitions as compared to MLPs who give a high cash distribution in one quarter and a low distribution in the next quarter.

Investors should look out for yields over a period of time instead of viewing only the current yield to make investment decisions about an MLP.

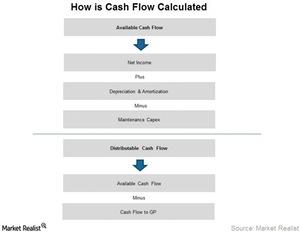

Maintenance capex versus growth capex

Maintenance capex is that part of the cash flow that is used to sustain the current cash flow, whereas growth capex is responsible for creating new assets through acquisitions, dropdowns, and building new assets. So in order to sustain current cash distribution, MLPs have to regularly incur maintenance capital expenditure to keep the assets in good shape.

Some of the MLPs that regularly incur both maintenance and growth capex in order to increase their cash distribution are MarkWest Energy Partners (MWE), Targa Resource Partners (NGLS), Summit Midstream Partners (SMLP), and NuStar Energy (NS). These MLPs have a combined weight of 27.5% in the Alerian MLP ETF (AMLP).

In the next part of the series, we’ll discuss the tax implications of investing in MLPs.