Rate Hikes Historically Lead to Muted Stock Returns

The last three rate hikes have seen negative three-month returns following the initial tightening period. Yet in the subsequent months, the S&P 500 Index rebounded.

May 22 2015, Published 4:12 p.m. ET

Market response to rate hikes

Not only is any tightening likely to be gentle and from an exceptionally low base, but tighter monetary conditions are generally associated with more volatility and downside risk, not bear markets.

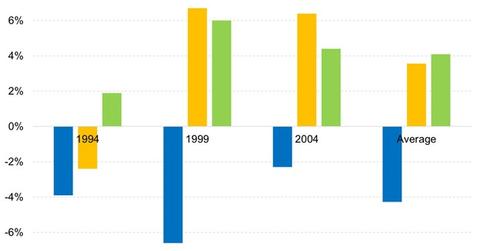

When you look at S&P 500 performance during rate cycles for various periods going back to the 1970s, a clear pattern emerges. Regardless of the period, 3-month returns following the start of a period of steady tightening were on average negative and more volatile, as markets initially reacted negatively to the start of a tightening cycle. However, looking out at 6 or 12 months, markets rebounded and generally produced positive, albeit sub-par, returns. The chart below looking at forward 3-, 6- and 12-month returns on the S&P 500 following an initial change in the Federal Funds target rate shows this pattern.

Market Realist: The rate hike could lead to muted stock returns

The last three rate hikes have seen negative three-month returns following the initial tightening period. Yet in the subsequent months, the S&P 500 Index (SPY) (VOO) rebounded. The average three-month, six-month, and twelve-month returns after tightening have been -4.3%, 3.6%, and 4.1%, respectively, since 1994.

So, while tightening is likely to be met with short-term volatility (VXX), the returns over slightly longer horizons, albeit muted, are unlikely to be negative. Given the fact that the federal funds rate is still at emergency levels, a gradual increase in rates shouldn’t hurt the markets to any great extent.

Nevertheless, lofty valuations are a concern and are making investors wary. As alluded to in the previous part, the current bull run is in its seventh year, and there doesn’t appear to be enough catalysts to drive stocks (VTI) forward. While the economy was expected to rebound in the second quarter, after a sluggish first quarter, economic data so far have been a mixed bag. While job creation bounced back in April, retail (XRT) sales have been flat.