Valuing MLPs: Price-to-Distributable Cash Flow Ratio

MLPs’ valuations are different from other stocks. To value MLPs, the widely used PE ratio isn’t as useful as the PDCF ratio.

April 9 2015, Published 11:28 a.m. ET

Price-to-distributable cash flow ratio

MLPs’ (master limited partnerships) valuations are different from other stocks. To value MLPs, the widely used PE (price-to-earnings) ratio isn’t as useful as the PDCF (price-to-distributable cash flow) ratio. Since MLPs generally distribute most of the available cash, DCF (distributable cash flow)—which removes all non-cash items—is a better metric for assessing MLPs’ performance than the earnings measure—which includes all of the non-cash items like depreciation.

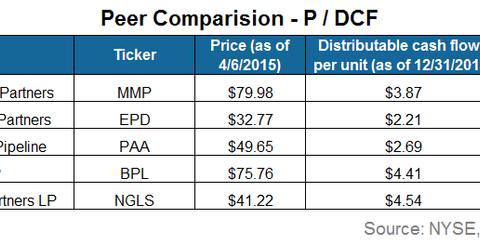

The above table computes the PDCF for five major players in MLP space—Enterprise Product Partners (EPD), Magellan Midstream Partners (MMP), Plains All American Pipeline (PAA), Buckeye Partners LP (BPL), and Targa Resources Partners LP (NGLS). The first four securities are part of top ten holdings of the Alerian MLP ETF (AMLP).

Relative performance

An MLPs’ standalone PDCF ratio doesn’t give us a full picture of how expensive the MLP stock is unless we look at it relative to the MLPs’ historical prices, its industry, or a broad market index—like the Alerian MLP Index (AMZ).

Historically, the MLP PDCF ratio has been in the range of 11x–15x. This could mean that except for Plains All American Pipeline and Targa Resources Partners LP (NGLS), the rest of the companies may be overvalued. However, these companies may not be overvalued. Some good companies may trade at a premium.

You can refer to Part 4 in this series for more details about the factors that affect distributions.

Bottom line

The PDCF ratio is a better metric for valuation of MLPs over the PE ratio. However, you shouldn’t make an investment decision based only on the PDCF ratio. The other important metrics that can be used to value MLPs are EV/EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization), the yield spread to the ten-year Treasury, and the Dividend Discount Model.

In the next part of this series, we’ll discuss how the movement in Treasury yields affects MLPs’ performance.