Teck Resources Zinc Operations Focused on Alaska’s Red Dog Mine

In 2014, its zinc operations contributed 31% to revenues and made up 27% of gross profit before depreciation and amortization.

April 10 2015, Published 10:35 a.m. ET

Zinc operations

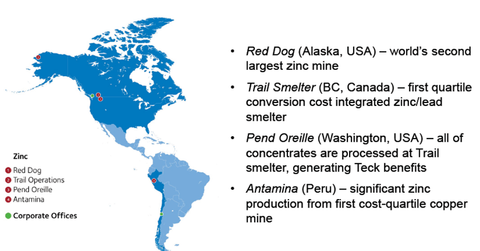

Previously in this series, we learned about the importance of Teck Resources (TCK) copper assets. In this part, we’ll look at its zinc operations. Teck Resources is the world’s third-largest producer of mined zinc. It has one of the largest integrated zinc and lead smelting and refining plants.

Glencore International (GLNCY) is another leading zinc miner. Glencore currently forms 2.82% of the iShares Global Materials ETF (MXI). Freeport-McMoRan (FCX) and Southern Copper (SCCO) respectively form 1.14% and 0.34% of MXI. Freeport also forms 3.25% of the SPDR S&P Metals and Mining ETF (XME).

Zinc capacity

Teck Resources has the capacity to produce 640,000 tons of zinc annually. It produces zinc primarily from its mines in Peru and the United States. Its mine in Alaska is the world’s second-largest zinc mine. In 2014, its zinc operations contributed 31% to revenues and made up 27% of gross profit before depreciation and amortization.

Red Dog Mine

Teck Resources zinc mine in Red Dog, Alaska, is a key driver of its earnings. In 2014, almost half the zinc segment’s revenues were attributed to Red Dog Mine. The mine was responsible for ~89% of the zinc segment’s gross profits before depreciation and amortization. Record production, coupled with higher zinc prices, boosted this segment’s 2014 earnings. In 2015, Teck Resources expects its Red Dog Mine will produce over 540,000 tons of zinc and 90,000 tons of lead.

Meanwhile, the location of this mine is exposed to severe winter conditions. This presents a potential risk for Teck investors.

Along with copper and zinc, Teck Resources has a significant energy portfolio.Freeport-McMoRan has also diversified into the energy exploration business. In the next part of our series, we’lll analyze Teck’s energy business.