Copper Industry Gets a Lift in 1H2015

In this series, we’ll discuss recent copper industry indicators. We’ll see how copper prices have done in 2015. We’ll also discuss copper supply trends and demand.

Nov. 20 2020, Updated 3:08 p.m. ET

Recent copper industry indicators

Copper prices were trading at $6,054 per metric ton on April 16. Copper is also known as “Dr. Copper” because analysts see copper prices as a reflection of global economic health. But there are others who say copper is just like any other industrial commodity. Copper prices reflect what other industrial metal prices do—demand–supply dynamics.

What we cover in this series

In this series, we’ll discuss recent copper industry indicators. We’ll see how copper prices have done in 2015. We’ll also discuss copper supply trends and demand.

China is the biggest consumer of copper, ditto for steel, iron ore, and aluminum. Tracking Chinese economic indicators is crucial for investors in the metals and mining space.

The SPDR S&P Metals and Mining ETF (XME) is an alternate play on the diversified metals and mining industry.

Wall Street performance

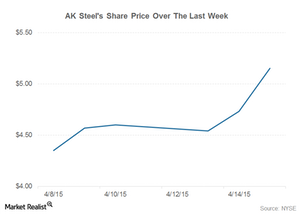

Freeport-McMoRan (FCX) lost more than 10% of its market capitalization this year. Yet, its share price rebounded by more than 7% on April 15, when US crude inventories came in lower than expected. Freeport has diversified into the energy exploration business over the last couple of years.

Teck Resources (TCK) stock has also been quite volatile amid rumors that it’s looking at a merger with Antofagasta. Both companies have now categorically denied that they’re engaged in merger talks.

Southern Copper (SCCO) is up ~5% since the start of 2015, and Turquoise Hill Resources (TRQ) is up by more than 30% over this period.

Copper prices directly impact the revenues of copper companies. In the next part of our series, we’ll analyze the latest copper price trends.