Analyzing Wendy’s Franchise Agreements

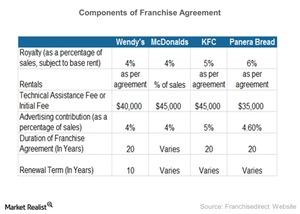

Wendy’s franchise agreements are only renewable after ten years. Wendy’s rental income from franchisees grew from $27 million in 2013 to $68 million in 2014.

April 2 2015, Updated 11:06 a.m. ET

Franchise revenue

Franchise revenue broadly falls into three categories:

- Royalties – this is usually a percentage of sales.

- Rents – rental income in case the franchisor owns the property and leases it to franchisees.

- Franchise fees or development fees – an initial fee for providing training and support.

Fixed income through rentals

From the above chart, you can see that Wendy’s (WEN) earns rentals. The rentals are fixed according to the terms of franchisee agreement—irrespective of the performance of the business. In contrast, McDonald’s (MCD) rentals are a percentage of sales. They’re subject to a minimum base rent that varies from contract to contract. As a result, McDonald’s depends on its franchisees’ business performance.

Companies in the fast food restaurant industry can be accessed through ETFs like the Consumer Discretionary Select Sector SPDR ETF (XLY). XLY holds 0.35% of Darden Restaurants’ (DRI) stock.

Tenure of franchise agreement

Wendy’s franchise agreements are only renewable after ten years. They provide stability in rental income. In contrast, KFC (Kentucky Fried Chicken)—under the umbrella of Yum! Brands (YUM)—as well as Panera Bread (PNRA) vary their terms of renewal based on each case. This gives them the flexibility to renew the agreements and consider factors like feasibility and franchisee performances.

System Optimization Initiative program

Wendy’s rental income from franchisees grew from $27 million in 2013 to $68 million in 2014. This is mainly because the company sold some of its stores to its franchisees. It earns rental income from them. The shifting from company-owned to franchise businesses is a part of Wendy’s System Optimization Initiative program. We’ll discuss the program in the next part of this series.