4 Methods of Investing in MLPs

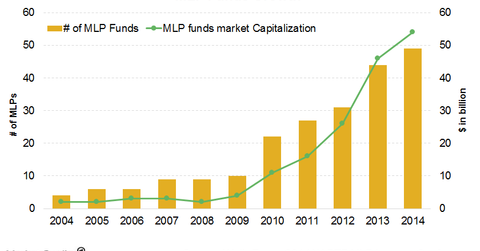

There are four methods of investing in MLPs. The MLP funds’ market cap reached $54 billion as of April 30, 2014. The number of MLP-focused funds reached 49.

May 4 2021, Updated 10:08 a.m. ET

MLP funds market

The flow of money into MLP (master limited partnership) funds increased over the past few years. The MLP funds’ market cap reached $54 billion as of April 30, 2014. The number of MLP-focused funds reached 49.

The above chart shows the trend in the MLP funds market. Now, we’ll discuss the methods of investing in MLP securities.

Methods of investing in MLPs

- Stocks – The most common method of investing in MLPs is through buying MLP units.

- ETFs – There are several ETFs that are designed to track a broad portfolio of MLPs. The largest MLP ETF is the Alerian MLP ETF (AMLP). It tracks the Alerian MLP Index—a capitalization-weighted composite of 50 energy MLPs. Its top three holdings include Enterprise Product Partners (EPD), William Partners LP (WPZ), and Magellan Midstream Partners (MMP). Other ETFs that have MLP exposure include the First Trust North America Energy Infrastructure ETF (EMLP) and the Yorkville High Income MLP ETF (YMLP).

- ETNs (exchange-traded notes) – ETNs are similar to ETFs, but they’re structured differently. ETNs are structured as a debt security issued by an underwriting bank. Like other debt, ETNs have a maturity date and are backed by the issuer’s credit. The most well-known ETN investing in MLPs is the JPMorgan Alerian MLP Index ETN (AMJ). AMJ tracks the Alerian MLP Index.

- Mutual funds – There are open-ended and close-ended funds that have MLP exposure. Open-ended funds include the Center Coast MLP Focus Fund (CCCAX) and the Oppenheimer SteelPath MLP Select 40 (MLPFX). Close-ended funds include the ClearBridge Energy MLP Total Return Fund (CTR) and the Kayne Anderson Midstream Energy (KMF).

ETFs versus mutual funds

Investors might prefer ETFs over mutual funds because ETFs have lower expenses than mutual funds. ETFs are passive and looking to track an index. In contrast, mutual funds are usually actively managed in order to outperform a benchmark. For mutual funds, the active management results in higher fees.