What do US inflation expectations mean?

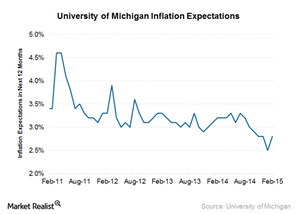

In 2014, inflation expectations were 2.8% to 3.3%. In January 2015, expectations dropped to 2.5%, the lowest since September 2010.

March 28 2015, Updated 2:05 a.m. ET

Inflation indices

Policymakers, including the Federal Reserve, look at inflation measures such as the Consumer Price Index (or CPI) and personal consumption expenditures (or PCE). These measures provide information about what has already happened.

There are a few measures, however, that hint at inflation expectations from the perspective of consumers and market participants. These measures are survey-based and market-based.

University of Michigan inflation expectations

One of these measures is the University of Michigan Inflation Expectation. It’s based on a monthly survey of inflation expectations among consumers. In 2014, over a 12-month period, inflation expectations ranged between 2.8% and 3.3%.

Although expectations were in a tight range, they dropped as the year progressed. In January 2015, expectations dropped to 2.5%, the lowest since September 2010. But in the latest reading in February, they picked back up to 2.8% for the coming 12 months.

Impact on gold

Higher inflation expectation is positive for gold on the one hand since it’s considered an inflation hedge. But on the other hand, inflation that rises in line the Fed’s expectation could be negative for gold.

The Fed watches inflation and other economic data very closely. Economic data , including the labor market, are improving consistently. If the Fed nears its inflation target, it will hike interest rates. This will be negative for gold prices (GLD) and gold stocks such as Goldcorp (GG), Barrick Gold Corporation (ABX), Newmont Mining (NEM), and gold-backed ETFs such as the SPDR Gold Trust (GLD).

An increase in interest rates will also negatively impact ETFs investing in gold stocks such as the VanEck Vectors Gold Miners ETF (GDX). GG, ABX, and NEM make up 10.2%, 8.5%, and 7.4% of GDX’s holdings, respectively.

Word of caution

The minutes of the Federal Open Market Committee’s (or FOMC) January meeting revealed that policymakers argued about the veracity of these survey-based measures.

So although the survey-based measures are helpful, their reliability is not set in stone.

In the next part of this series, we’ll see how US inflation impacts US real interest rates, which in turn impact gold prices.