How J.P. Morgan Ranks in Corporate and Investment Banking

In the US, J.P. Morgan competes with Bank of America (BAC), Goldman Sachs (GS), and Morgan Stanley (MS), the leading players in investment banking.

April 22 2015, Updated 12:15 p.m. ET

Services offered

J.P. Morgan’s (JPM) Corporate and Investment Bank segment offers a range of investment banking, market-making, prime brokerage, and Treasury and securities products and services. It provides these products and services globally to corporations, investors, financial institutions, government, and municipal entities. Investment banking services include advising on corporate strategy and structure, capital-raising in equity and debt markets, as well as loan origination and syndication.

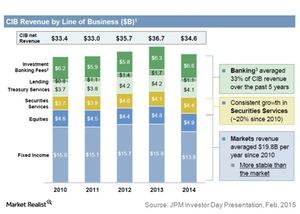

Revenue breakdown by business line

The graph above shows the segment’s revenue breakdown by business. Markets revenue, made up of fixed income and equity sales and trading, contributes more than half of the segment’s revenue. Sales and trading revenue primarily includes gains and losses on trading assets, net interest income, and commissions on equity securities. This is followed by investment banking fees, which contribute ~19% of the segment’s total revenues.

The decline in revenues was partially a result of some business simplification efforts that the bank undertook in 2014. You’ll learn more about these initiatives later in this series.

Leading market share in key business lines

J.P. Morgan controls ~8.1% of the global investment banking fees, making it number one in a Dealogic ranking. It also ranked number one in fixed income markets and number three in equity markets.

It appears in the top three in 15 out of 16 product areas, as shown in the table above. In the US, J.P. Morgan competes with Bank of America (BAC), Goldman Sachs (GS), and Morgan Stanley (MS), the leading players in investment banking. Together, these four companies form ~17.5% of the Financial Select Sector SPDR ETF (XLF).

About half the segment’s revenues come from North America, one-third from EMEA (Europe, Middle-East, and Africa), and the remaining revenues from Asia-Pacific countries and Latin America.