J.P. Morgan Looks to Deepen Customer Relationships

The number of J.P. Morgan active mobile customers has more than tripled since 2010. As a result, the bank is adapting its digital capabilities.

April 22 2015, Updated 11:34 a.m. ET

Consumer banking

J.P. Morgan’s (JPM) Consumer Banking business offers deposit and investment products and services to consumers. It also provides lending, deposit, and cash management and payment solutions to small businesses. The bank offers services through more than 5,000 branches and over 18,000 ATMs. It has more than 19 million active mobile users.

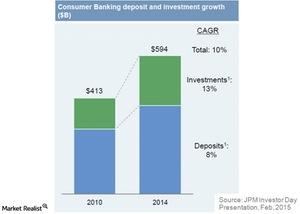

Deposits are growing

J.P. Morgan’s deposit and investment growth is shown in the graph above. Its deposits grew at a compound annual growth rate, or CAGR, of 8% over the last four years. The bank is adopting a number of initiatives to drive this growth. One such initiative is to develop the customer base. Deposit-and-investment customers have lower attrition rates than deposit-only clients. They don’t switch to other banks so quickly.

Changing customer preferences

Two other initiatives the bank is undertaking to retain clients and grow its customer base are optimizing its branch network and adopting digital capabilities.

The number of J.P. Morgan active mobile customers has more than tripled since 2010. As customer transactions migrate to digital channels like online and mobile, the bank is adapting its digital capabilities.

Still, branch banking remains indispensable. Branches are also a core distribution channel for the bank’s other products. While routine transactions become more automated, branches are focused on financial advice and other value-added services.

The bank attends to both branch and digital channels to meet changing consumer preferences. Competitors Bank of America (BAC), Citigroup (C), and Wells Fargo (WFC) are also actively adapting to changing customer preferences.

J.P. Morgan makes up ~7.3% of the Financial Select Sector SPDR ETF (XLF).