J.P. Morgan and Its Diversified Funding Sources

Banks like US Bancorp (USB) and Wells Fargo (WFC) have an advantage over J.P. Morgan in terms of debt rating. Both banks secure higher ratings.

April 22 2015, Updated 12:13 p.m. ET

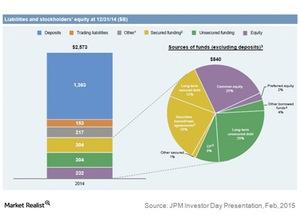

A diversified funding profile

Deposits fund 53% of J.P. Morgan’s (JPM) total assets. The deposit mix is diversified both by type and by line of business. The firm’s deposits consist of 10% time deposits and 31% non-interest bearing deposits. Banks have to pay low or no interest on non-interest bearing deposits. On the other hand, interest cost is highest for time deposits.

Of its remaining 47% non-deposit-funded assets, over a quarter are funded by common and preferred equity. And, more than one third of the remaining assets are funded by unsecured funding including long-term unsecured debt, commercial papers, and other borrowed funds.

Secured funding, including securities loaned or sold under repurchase agreements, long-term secured debt, and other secured debt, fund the remaining assets. The graph above gives a breakdown of the company’s funding sources.

Deposits are the cheapest source of funds

Deposits are the most crucial source of funds for any bank. They’re also the cheapest, which can affect the bank’s overall funding costs. Banks with lower-cost deposits have a competitive advantage over other banks.

Banks also need some long-term funding sources such as debt and equity capital. A bank’s credit rating affects the cost and availability of financing. Reductions in credit ratings could increase the cost of funds and decrease the number of investors willing to lend to the firm.

Banks like US Bancorp (USB) and Wells Fargo (WFC) have an advantage over J.P. Morgan in terms of debt rating. Both banks secure higher ratings from most agencies than J.P. Morgan. The Bank of America’s (BAC) ratings, on the other hand, are generally lower. Together, these four banks form ~24.5% of the Financial Select Sector SPDR ETF (XLF).