Johnson & Johnson’s Medical Devices and Diagnostics Segment

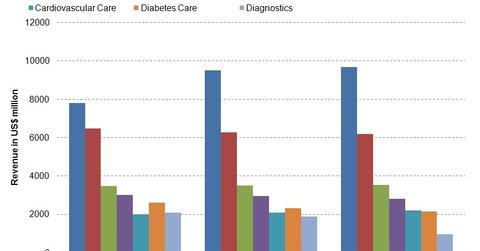

The Medical Devices and Diagnostics segment contributes over 37% of Johnson & Johnson’s revenue. In 2014, the segment generated about $27.5 billion in revenue.

March 12 2015, Updated 3:40 a.m. ET

Medical devices segment

The Medical Devices and Diagnostics segment contributes over 37% of Johnson & Johnson’s (JNJ) revenue. For the last three years, the orthopaedics franchise has been a key driver for the company’s growth in this segment.

For 2014, the segment generated revenue of about $27.5 billion through the worldwide sales of medical devices. This was a 3.4% decrease compared to the year before. The decrease was partially due to the divestiture of the Ortho-Clinical Diagnostics business to The Carlyle Group in June 2014. It was also due to the negative impact of currencies.

As a percentage of sales, the pre-tax profit for this segment was 28.9% in 2014. This was achieved due to a $1.9 billion gain on the divestiture of the Ortho-Clinical Diagnostics business and lower litigation expenses.

The company is planning to exit certain women’s health products.

Products

The segment includes products used in the orthopaedic, surgical care, specialty surgery, cardiovascular care, diagnostics, diabetes care, and vision care markets. Key products from this segment are:

- orthopaedic franchise – joint reconstruction, trauma, sports medicine, knee, and hip products.

- surgical care franchise – sutures and the Endopath stapler

- specialty surgery franchise – biosurgical products and energy products

- vision care franchise – Acuvue and Vistakon products

- cardiovascular care franchise – Biosense Webster products and the ThermoCool SmartTouch contact force sensing catheter

This segment distributes its products to wholesalers, hospitals, and retailers. The products are mainly used in the professional fields by physicians, nurses, hospitals, and clinics.

Brands

A few of the segment’s devices include:

- DePuy Synthes for orthopaedic products

- Cordis and Biosense Webster for cardiovascular products

- Codman Neuro and DePuy Synthes for neurovascular diseases

- Lifescan and Animas corporation for diabetes care

- Vistakon and Acuvue for vision care products

- Ethicon and Codman Neuro for general surgery products

- Ethicon and Mentor for aesthetics products

- Acclarent for ear, nose, and throat conditions