An investor’s guide to Freeport-McMoRan

Freeport-McMoRan (FCX) is a leading natural resources company. It’s among the top copper producers and holds the position of largest molybdenum producer.

March 6 2015, Published 4:22 p.m. ET

Freeport-McMoRan: An overview

Freeport-McMoRan Inc. (FCX) is a leading natural resources company. It’s among the top copper producers and holds the position of largest molybdenum producer. Freeport also has interests in gold mining.

Over the years, Freeport has diversified into energy production. It now holds a significant portfolio of oil and natural gas assets.

Its operations are spread across several countries. The company, which is headquartered in Phoenix, Arizona, employs more than 36,000 people across various functions.

What’s going on with Freeport?

In this series, we’ll present an overview of Freeport-McMoRan. We’ll also discuss Freeport’s key financials and its competitive landscape.

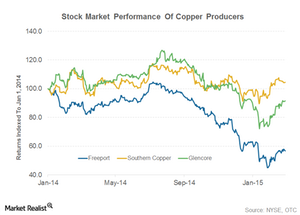

Freeport’s competitors and some of the world’s major copper producers include Southern Copper Corp. (SCCO), Teck Resources (TCK), and Glencore International plc (GLNCY). Freeport currently forms 3.16% of the SPDR S&P Metals and Mining ETF (XME).

Later in this series, we’ll discuss how investors can play Freeport-McMoRan. Its share price was quite volatile over the last few months. The above chart shows the movement in Freeport’s share price since the start of 2014.

Commodity slowdown

Commodity companies have been victims of the slowdown in the global economy. The demand slowdown in the Chinese economy has negatively impacted all major commodities. Iron ore prices recently fell to a five-year low. Steel prices in the United States have also corrected sharply.

Copper is often referred to as Doctor Copper for its so-called Ph.D. in economics and its ability to predict changes in the global economy. Thus, investors track copper prices as a leading indicator of the world economy.

In the coming parts of this series, we’ll look at the trends in copper prices and their impact on Freeport-McMoRan.