Higher Disposable Income: A Reason for Restaurants to Cheer

Disposable income increased by 40 basis points month-over-month in January. On a YoY (year-over-year) basis, disposable income increased 9.5%.

March 30 2015, Updated 7:05 p.m. ET

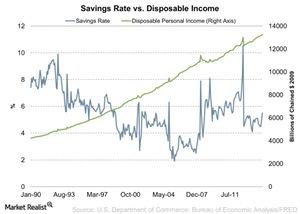

Saving rate and disposable income

The savings rate is the amount expressed as a percentage of disposable income that hasn’t been expensed. Income put aside in a retirement account, stocks, 401(k), or money market funds are considered savings. Disposable income is the personal income left after income taxes.

Interpretation

The BEA (U.S. Bureau of Economic Analysis) releases a monthly savings rate as well as disposable income data. The savings rate increased by 50 bps (basis points)—100 bps equals 1%—month-over-month in January. Disposable income increased by 40 bps month-over-month in January. On a YoY (year-over-year) basis, disposable income increased by 9.5%. You can see this in the above chart.

Positive for restaurants

Personal disposable income has been rising since January 1990. However, the personal savings rate has been volatile. The savings rate dropped sharply in 2013 to 5% YoY. This could mean that consumers are spending more. This is positive for restaurants like Chipotle Mexican Grill (CMG), Panera Bread (PNRA), Taco Bell under the umbrella of Yum! Brands (YUM), and Darden Restaurants (DRI).

It’s also positive for ETFs like the Consumer Discretionary Select Sector SPDR (XLY). XLY holds 1% of Chipotle Mexican Grill. The iShares Global Consumer Discretionary ETF (RXI) holds about 2.5% of McDonald’s (MCD).

Revolving credit also decreased to $887.9 billion in January. It was $889 billion last month. This could be because people were spending more and borrowing during December. A better measure of consumption is the PCEPI (personal consumption expenditure price index). We discussed the PCEPI earlier in this series.

Takeaways for the restaurant industry

Consumer confidence is closely tied to spending. If consumer confidence is high, it means people are optimistic about the economy and their jobs. This results in more spending. In the next part of this series, we’ll look at consumer confidence in more detail.