Dr Pepper Snapple pursues non-carbonated beverage growth

Keeping in view declining soda volumes, Dr Pepper Snapple is focusing on expanding its non-carbonated beverage line.

March 5 2015, Updated 5:08 p.m. ET

Liquid refreshment beverage market

The liquid refreshment beverage (or LRB) market includes carbonated and non-carbonated beverages. According to Beverage Digest, the US LRB market is predominantly ruled by Coca-Cola and PepsiCo, which together held a 60% market share in 2013. Dr Pepper Snapple (DPS) ranked third with a 10.9% LRB market share. Compared to the beverage giants, Dr Pepper Snapple doesn’t have a major presence in the non-carbonated beverage category. About 80% of the company’s volume comes from carbonated soft drinks (or CSDs).

Growing the non-carbonated beverage line

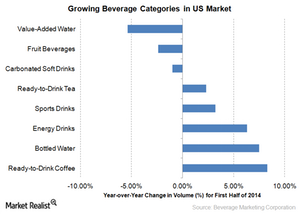

The above graph reflects a shift in consumers’ preference towards non-carbonated beverages like ready-to drink tea and coffee and bottled water. Keeping in view this trend and declining CSD volumes, Dr Pepper Snapple is focusing on expanding its non-carbonated beverage line. Brand extensions in 2014 included Mott’s Fruit Punch Rush, Wild Grape Surge, and Strawberry Boom.

According to Beverage Industry Magazine, Dr Pepper Snapple announced, at a recent trade show, a number of new products for 2015, including Snapple Whoa-Conut, Snapple Straight Up, Snapple Lady LiberTea, and Mott’s Tropical Ba-Na-Na!.

About 54% of the company’s innovation pipeline focuses on health and wellness products across the non-carbonated as well as carbonated beverage categories.

Strong allied brands

The company’s third-party brands like Vita Coco coconut water, Bai5, and FIJI Water have experienced strong growth and are facilitating the company’s expansion into the non-carbonated beverages category. In 2014, the company’s Packaged Beverages segment derived 17% of its net sales from the distribution of third-party brands.

Strengthening distribution to support growth

To ensure proper distribution of its non-carbonated as well as its carbonated beverages, the company is strengthening its distribution capabilities through the acquisition of regional bottlers. The company’s 2014 acquisition of Davis Beverage Group and Davis Bottling Co. almost doubled its direct-store-delivery (or DSD) footprint in Pennsylvania. Currently ~40% of the company’s DSD volume is manufactured and distributed through third parties like Coca-Cola (KO) and PepsiCo (PEP) affiliated bottlers.

As of February 26, 2015, the Consumer Staples Select Sector SPDR Fund (XLP) and the SPDR S&P 500 ETF (SPY) invest 0.98% and 0.08% of their holdings, respectively, in Dr Pepper Snapple.

The company’s growth strategies combined with its productivity initiatives have helped it in gaining investor confidence as reflected in its stock price appreciation.