Why Darden Restaurants Sold Red Lobster

Activist investor Starboard Value opposed Red Lobster’s sale, stating that Darden management could do more to turn the undervalued brand around.

March 25 2015, Updated 5:36 p.m. ET

Red Lobster’s struggles

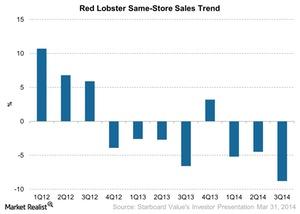

On May 15, 2014, Darden Restaurants (DRI) entered in an agreement to sell its Red Lobster restaurants to private equity firm Golden Gate Capital for $2.11 billion. As you can see in the chart below, Red Lobster has been struggling since 2012.

According to Darden, it sold Red Lobster to generate higher value for the company and its shareholders. This sale would allow Darden to retire an outstanding debt of $1 billion, as well as to maintain its annual dividend of $2.20. There would also be an additional savings of $60 million in operating expenses, but the general and administrative expenses would remain unchanged as a percentage of sales.

Starboard opposed the sale

According to Forbes, activist investor Starboard Value opposed this sale of Red Lobster, stating that the company was undervalued and that Darden management could do more to turn Red Lobster around. This also triggered Starboard’s move to nominate candidates to replace Darden’s board. Starboard Value was successful in replacing Darden’s board at the end of 2014, which also resulted in replacing the CEO.

Golden Gate Capital is also an investor in California Pizza Kitchen, a casual dining restaurant that competes with Olive Garden; Chili’s, under the umbrella of Brinker International (EAT); Carrabba’s Italian Grill, under the umbrella of Bloomin’ Brands (BLMN).

Darden Restaurants (DRI) is included in the Consumer Discretionary Select Sector SPDR ETF (XLY), which holds 1% of Chipotle Mexican Grill (CMG) stock and 4% of McDonald’s (MCD) stock.