Why Corporate Bonds Correlate to Stocks

Corporate bonds, especially high yield corporate bonds, correlate to equities and hence, so they don’t provide great diversification benefits.

March 24 2015, Updated 3:07 p.m. ET

Investors who properly appreciate economic and financial fundamentals — particularly the vital three of leverage, liquidity and cash flows – have the best chance of being rewarded.

At the same time, the reality is that the days of simply relying on one fixed income fund or style are over. When thinking about your fixed income investment options, bear in mind that over the past several years, traditional bond funds have become much more correlated to stocks. Plenty of actively managed bond funds have veered away from their benchmark and taken on more risk in the pursuit of higher returns. And any single component of the income sector has experienced significant loss of capital during times of market stress.

Market Realist – Corporate bonds correlate with stocks.

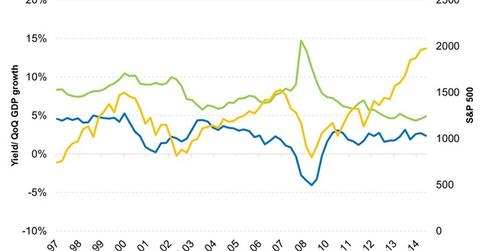

The graph above compares the quarterly GDP (gross domestic product) growth rate with the S&P 500 (SPY) and the yield on corporate bonds rated BB by the S&P. The latter fall under the “junk bond” (HYG)(JNK) category.

As we saw in Part 2 of this series, corporate bonds (AGG) correlate more with equities than Treasuries (IEF). You can see that trend in the graph above. Junk bond yields rise and their prices fall when GDP growth rates slip. Equities correlate to the GDP growth rate. This relationship is intuitive, given that earnings are the biggest drivers of stock prices.

Also, as we explained in the last part, a lower rating corresponds to higher credit risk, which drives up the yield required to compensate investors’ risk. When the economy improves, so do cash flows, which reduce the probability of default. This reduction makes them attractive for investors hungry for yield, which is why their prices rise and yields fall. The opposite happens when the economy deteriorates.

Corporate bonds, especially high yield corporate bonds, correlate to equities and hence, so they don’t provide great diversification benefits, as we saw in Part 2.