Why the composition of banking assets matters

The two main types of banking assets are loans and securities held.

March 4 2015, Updated 12:06 p.m. ET

What are banking assets?

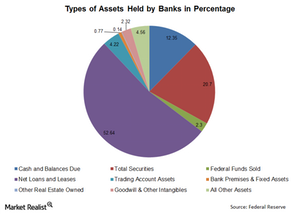

The previous article in this series indicated that asset growth picked up and was strong throughout 2014. To further analyze this trend, it’s important to understand various types of assets a bank owns. Now, let’s look at asset types in detail.

Two main types of banking assets

The two main types of banking assets are loans and securities held. Assets include cash, premises, real estate, and other fixed assets. These assets earn minimal or very low revenue for the bank.

Loans are the largest asset type for a bank

The main income earning assets for a bank are loans. A bank earns income on loans by charging an interest rate for the duration of the loan. At the end of 2014, loans accounted for 52.64% of total assets that banks held in the US. There are many banks that primarily focus on loans, such as Wells Fargo (WFC) and US Bank (USB). In addition to WFC and USB, the Financial Select Sector SPDR (XLF) also holds smaller loan-focused banks. These small banks have low weights in the XLF portfolio.

Securities are more important for investment banks

The second most important revenue-earning asset for banks are the securities the bank holds. A bank earns income from securities by earning interest income on them or by trading them. Government securities are the most important type of securities a bank owns. At the end of 2014, securities accounted for 20.7% of total assets that banks held.

Securities are even more important for investment banks. Investment banks have large trading books. They earn a good part of their income from trading securities. Examples of banks where securities are a good portion of the asset book are JP Morgan (JPM) and Bank of America (BAC).