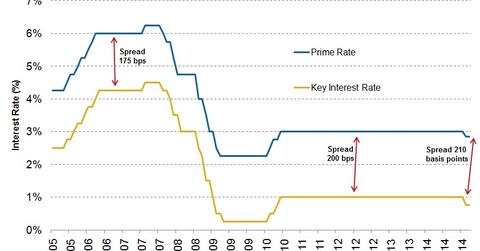

The widening spread in the Canadian prime and key interest rates

The “Big Six Banks” in Canada have only reduced their prime rates by 15 basis points. So the spread between the prime and key interest rates is now 0.1%.

Nov. 20 2020, Updated 10:44 a.m. ET

“Big Six Banks” contribute to widening spread by passing on marginal benefit

Although the Bank of Canada may have reduced its key interest rate by 25 basis points, as explained in the previous part of this series, the benefit has only been marginally passed on to Canadian consumers.

The “Big Six Banks” in Canada have only reduced their prime rates by 15 basis points, or bps. This means that the spread between the key interest rate and the prime rate in Canada has increased by a further 10 bps or 0.1%.

Spread between key interest rate and the prime rate has widened in Canada

The spread between the Bank of Canada’s overnight lending rate and the prime rate, after the 15 bps reduction, is now 210 bps. The spread has stood at a 2%, or 200 bps, gap for years. However, with the key interest rate reduced to 0.75%, and the prime rate reduced to 2.85%, the spread between the two is now 2.10%, or 210 bps.

Historically, the spread has been narrower, at 1.75% or 175 bps. In late 2008, when the central bank’s overnight rate was slashed by 75 basis points, Canadian banks such as the Toronto-Dominion Bank (TD), Royal Bank of Canada (RY), Bank of Montreal (BMO), Bank of Nova Scotia (BNS), and Canadian Imperial Bank of Commerce (CM) passed on only a 50 basis point cut to their customers.

The difference has resulted in the spread widening by 25 basis points. The iShares MSCI Canada ETF (EWC) has allocated up to 32.83% of its portfolio to financial services institutions in Canada.

Implications for Canada and your investments

Home-equity lines of credit and variable-rate mortgages, both based on the prime rate, make up about 25% of the mortgage market in Canada. With the prime rate benchmarked to the key interest rate, consumers start expecting an equivalent drop in their loan or mortgage interest rates.

However, when only a part of that benefit is passed down to consumers, it increases Canadian apprehensions about the health of the financial sector, which is dominated by the “Big Six Banks.”

As well, while the 15 bps cut in rates may be good news for variable-rate mortgage holders, and line-of-credit borrowers, it’s certainly not good news for the Canadian dollar, which is trending south, spreading a negative outlook for the economy. The fixed-rate auto loan holders also seem to have seen no immediate benefit from the rate cut.

Another rate cut in March expected

Markets are expecting that the central bank will lower its benchmark interest rate by another 25 basis points, to 0.5%, at its March 4 meeting. Key reasons cited for the expectation are a patchy job market, continued pressure on oil prices, and the reluctance among Canadian banks to pass on the benefit of the rate cut to consumers.

Investors in America are currently waiting for two things to help them make decisions about their investments in the country:

- the possibility of another rate cut in Canada

- interest rates rising the US

We’ll keep you informed and updated on the investment impact of such events through our Developed Market ETFs page. Meanwhile, our Market Realist series, A key guide to positioning your portfolio for rising rates, can help you prepare for the expected interest rate rise in US.