How the health insurance industry manages risks

The health insurance industry mainly gives individuals a risk management tool. People can’t predict the extent or timing of their their healthcare expenses.

Feb. 3 2015, Published 3:47 p.m. ET

Need for health insurance

The health insurance industry (XLV) mainly provides individuals a risk management tool. People can’t predict the extent and timing of their future healthcare expenses. By paying regularly for health insurance, people get protection from financial losses through high healthcare expenses. Insurance also helps people better manage their cash flows. Most health insurance plans specify the maximum amount an individual will need to pay in excess of the charge for buying the insurance in a calendar year.

Risk pooling

According to study by the Congressional Research Service, the top 5% of the total population accounted for about 50% of health expenses in 2011 and 2012. This uneven distribution of spending forms the basis of risk pooling, where people contribute an amount of money at least equal to the per-capita cost of medical services expected by the group of insured people. Risk pooling in insurance is essentially a cross-subsidy paid by low-risk members to high-risk members of the insurance plan.

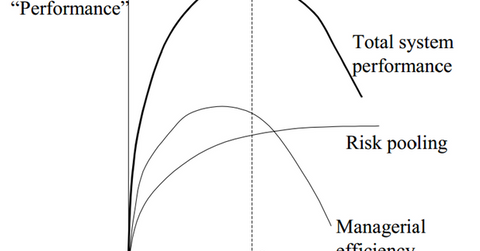

The above diagram shows that the performance of the healthcare system—or the efficiency of health insurance and the effectiveness of risk pooling—increases as the size of the group increases. However, the benefit of reduced risk from an increasing insured population becomes almost stable as the size increases after a certain optimal size. As the size increases, the probability of increases in similar risk characteristics also increases. This trend reduces the chances of cross-subsidy.

Managerial efficiency involves activities such as monitoring information, collecting premiums, and transferring payments to healthcare providers. Managerial efficiency tends to decline if the size of the group exceeds the optimal size.

Insurance companies such as Aetna (AET), Humana (HUM), Cigna (CI), and Anthem (ANTM) also have to consider factors like the level and distribution risk pool participants’ income and the expected revenue of each risk pool. If there’s a large difference in the characteristics for different risk pools handled by the same insurance company, the company transfers funds inter-pool to manage risks.