Understanding health insurance companies’ major operating expenses

The operating expenses of the private health insurance industry depend on the design of health plans and on the life history, age, and health of enrollees.

Feb. 13 2015, Updated 1:05 p.m. ET

Operating expenses

The operating expenses of the private health insurance industry (XLV) mainly depend on the design of the health plans offered and on the life history, age, and health of enrollees. These two factors determine the medical service utilization and the coverage that the private insurer provides for these services.

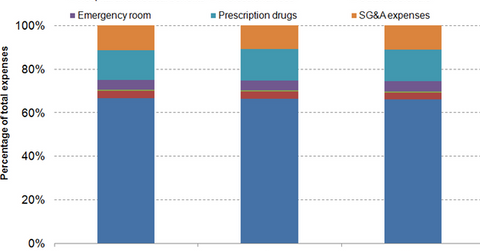

The above graph shows the breakup of a private insurance company’s operating expenses based on the expenses of the five major managed care organizations, also called the “big five” in the health insurance industry. These companies are Aetna (AET), Humana (HUM), UnitedHealth Group (UNH), Anthem (ANTM) and Cigna.

In-network expenses

The graph shows that hospital and medical benefit expenses have slightly declined from 2011 to 2013. Meanwhile, prescription drug expenses have gradually increased. The former is a result of the shift of patients from inpatient treatment to more cost-optimal outpatient centers coupled with the use of preventive health measures to control the utilization of medical services.

With an increase in the insured population, people suffering chronic ailments such as diabetes, high blood pressure, and high cholesterol are consuming more medicine. To control drug-related costs, health insurers are classifying drugs in different tiers based on theirs cost for the drug and the availability of over-the-counter substitutes. Based on the tier of the drug required, copayments are adjusted, with generic drugs requiring lower copayments compared to brand-name drugs.

The increase in emergency room (or ER) expenses has been a result of Medicaid expansion, leading to a rise in the low-income insured population using the expensive ER services.

Out-of-network expenses

Outside referral costs remain stable, as health insurers are actively restricting the choice of doctors and hospitals. Insurance companies are creating narrower networks of health providers and only pay out-of-network costs for emergencies.