How key drivers impact insurance sales

For P&C insurers such as AIG and ACE, various mandatory requirements may drive sales of vehicle, workers’ compensation, and homeowners insurance.

Nov. 19 2019, Updated 6:14 p.m. ET

GDP growth as a driver

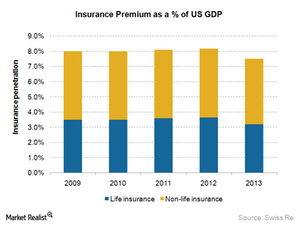

In the United States, GDP growth has been seen as a key driver for insurance sales growth. As shown in the chart below, insurance premiums historically contributed around 8% of GDP in the US, with ~3.5% being spent for life insurance and ~4.5% being spent for non-life insurance.

However, in 2013, the insurance penetration—the term for insurance premiums as a percentage of GDP—dropped slightly for both life insurance and non-life insurance. This dip in sales volume resulted in lower growth when compared to the economy’s overall growth.

Other drivers

Sales of life insurers such as MetLife (MET), Prudential Financial (PRU), and AFLAC (AFL) are also impacted by the performance of the financial markets. Among these insurers’ most popular product types include investment-linked products such as variable annuities. The payout of these policies is linked to the performance of the financial markets.

As equity markets go up, it is common to find increased investments in these products. Variable annuity sales volume tracks the equity market performance, as shown in the chart above. At a broader level, premium growth in the industry is impacted by such market performance, represented by performance of the SPDR S&P 500 ETF (SPY) because of the large contribution of annuity-type products in the life insurance industry’s revenue.

For P&C insurers such as AIG (AIG) and ACE (ACE), various mandatory requirements by regulation or other parties may drive sales. In many cases, personal and commercial vehicle insurance, workers’ compensation insurance, and homeowners insurance must be purchased due to legal or third-party requirements.

Accounting for sales

An insurer may account for sales using various terms. Gross written premium (or GWP) is the premium paid by the policyholders. Out of this, an insurer cedes some of the premium to a reinsurer for sharing some of the risk. Also, adjustments are made to exclude unearned portion of the premium, which is the premium received for risk coverage for a future financial period.

After this adjustment, the premium retained by the insurer is known as net earned premium (or NEP). NEP is frequently used as a base to calculate an insurer’s operating margin. In the next few articles, we’ll look at how an insurer’s business model impacts its profit.