Aflac Inc

Latest Aflac Inc News and Updates

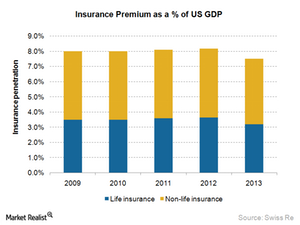

How key drivers impact insurance sales

For P&C insurers such as AIG and ACE, various mandatory requirements may drive sales of vehicle, workers’ compensation, and homeowners insurance.

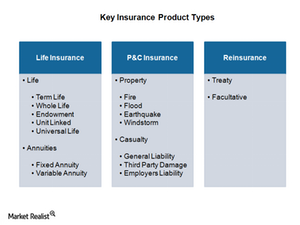

Life insurance, P&C insurance, and reinsurance

P&C products have commoditized characteristics, resulting in sharp competition in the market and business cycles. AIG and ACE are key players in this space.

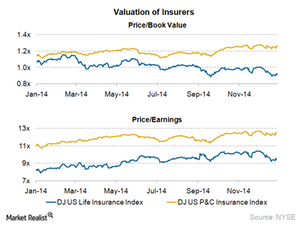

How valuation of insurance companies works

Financial market movements not only impact income from invested assets, but also the value of assets carried at fair value on an insurer’s balance sheet.

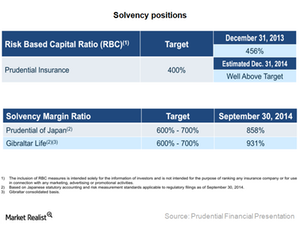

Prudential Financial Enjoys Strong Solvency Ratios

Prudential has comfortable solvency positions in its subsidiaries. In the US, Prudential Insurance’s solvency ratio was well above the target ratio of 400%.

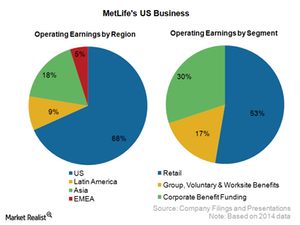

MetLife is a leading player in the US insurance industry

MetLife intends to grow its retail business and expects low single-digit growth in the long term.

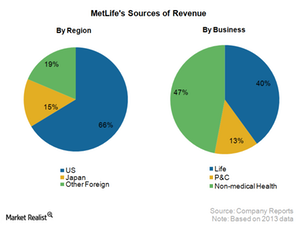

MetLife – A globally diversified insurance company

MetLife is a market leader in the US and the largest life insurer in Mexico and Chile. It is among the leading players in Japan, Korea, and Poland.