NEE Has One of the Cleanest Generation Mixes in the US

NextEra Energy (NEE) has one of the cleanest generation mixes among peers.

Nov. 20 2020, Updated 3:48 p.m. ET

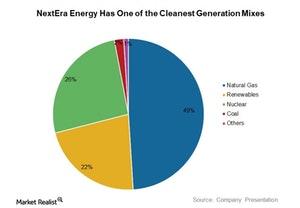

NextEra Energy’s generation mix

NextEra Energy (NEE) has one of the cleanest generation mixes among peers. In 2016, it generated nearly 50% of its total power from natural gas, while coal accounted for just 2%. Nuclear power made up 26% of its total generation, while renewables accounted for 22%.

According to a recent company presentation, NextEra Energy’s carbon emission rate was 52% lower than the US utility sector average in 2015.

Among peers, Duke Energy (DUK) and Xcel Energy (XEL) have coal-dominated generation mixes. American Electric Power (AEP) and FirstEnergy (FE) generate more than half of their total power from coal.

NextEra Energy’s competitive energy operating arm, NextEra Energy Resources (or NEER), has a cleaner generation portfolio than its parent. It currently has 20 GW (gigawatts) of generation in operation. Of this, 70% is wind and 10% is solar. Fossil-fuel-driven capacity accounts for less than 5% of NEER’s total generation.

With constant improvements in technology, NextEra Energy aims to improve the capacity factor of wind generation significantly in the next years. The capacity factor of an installation is the ratio of actual electricity output in a given period to total possible output over the same period.

US generation mix

Weak natural gas prices over the last few years have drastically changed the US power generation mix. In 2008, coal was responsible for almost half of the total production in the country, while in 2016, coal accounted for 30% of total power production. Since then, coal’s share has been falling and has been grabbed by natural gas and renewables. Natural gas accounted for 34%, and renewables accounted for nearly 15% of total generation in 2016.

Renewables are expected to drive the US power industry (XLU) for the next several years. According to Bloomberg New Energy Finance, by 2020, wind and solar capacity in the US will rise by nearly 60 GW.