Why Monster Beverage’s international business is growing

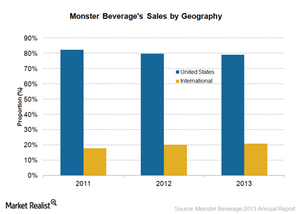

Monster Beverage’s revenues from international regions increased over the years. Its international operations accounted for 21% of its 2013 revenues—up from 18% in 2011.

Jan. 7 2015, Updated 8:04 a.m. ET

Opportunities abroad

Non-alcoholic beverage makers—like The Coca-Cola Company (KO), PepsiCo, Inc. (PEP), and Monster Beverage Corporation (MNST)—are aggressively looking for growth opportunities beyond the domestic US market. According to market research firm Canadean, the average global per capita consumption of energy drinks is currently quite low at one liter per day. It’s expected to more than double by 2018.

Growing international sales

Monster Beverage’s revenues from international regions increased over the years. The company’s international operations accounted for 21% of its 2013 revenues—up from 18% in 2011. In 2013, the company’s international revenues grew by 12.4% to $467.2 million.

Expansion plans

To meet the global demand, Monster Beverage is on track to launch its energy drinks in certain countries in Asia, Central and Eastern Europe, and Africa. In October 2013, the company’s distributor started sales in India. Monster Beverage continues to gain momentum in Europe, particularly in the United Kingdom, Spain, Greece, Germany, Sweden, and Italy.

In 1Q14, the company started to produce its drinks in Japan. It plans to start production in other regions—like Korea, India, and South Africa. Monster Beverage believes that local production plants in certain international markets will help it improve its margins by reducing freight costs and damages.

Competitors’ international brands

Monster Beverage’s energy drinks compete in the international market with with Red Bull, Rockstar, Burn, V Energy, Lucozade, Adrenaline Rush, Relentless, and other local and private label brands across different countries.

Peers’ international reach

Monster Beverage’s closest rival is Austria-based Red Bull GmbH. It has a strong hold over the international market. Red Bull has a leading 31.5% global market share. Coca-Cola and PepsiCo derived 57.7% and 49.4% of their 2013 revenues, respectively, from international operations.

Favorable factors—like a growing population, higher disposable income, and a rising middle class—will drive energy drinks’ demand, especially in the emerging markets.

There are several ETFs that provide exposure to the emerging markets—like the iShares MSCI Emerging Markets Fund (EEM). EEM tracks the investment results of an index composed of large and mid-sized equities in the emerging markets.