Exploring Universal Health Services’ major markets

Universal Health Services (UHS) earns more than 50% of its total revenues from the Texas, Nevada, Florida, California, and District of Columbia markets.

Jan. 2 2015, Updated 11:15 a.m. ET

Major markets

Universal Health Services (UHS) earns more than 50% of its total revenues from the Texas, Nevada, Florida, California, and District of Columbia markets.

Nevada

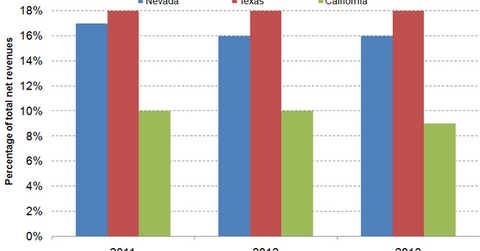

Universal Health Services operates six acute care hospitals and four behavioral healthcare facilities in the Nevada market, of which five acute care hospitals and two behavioral health hospitals are located in Las Vegas. These facilities together contributed about 16% of the total revenues and 6% of the operating earnings in 2013.

Texas

Universal Health Services owns seven acute care hospitals and 22 behavioral healthcare facilities in Texas. In Hildalgo County in South Texas, the company owns three acute care hospitals and one behavioral health hospital. Universal Health Services has 25% market share in the South Texas market, which has been ranked the 24th fastest-growing healthcare market in the US. In 2013, Texas contributed about 18% of Universal Health Services’ total revenues and 15% of the company’s operating earnings.

California

Universal Health Services owns five acute care hospitals and six behavioral healthcare facilities in California. These facilities together contributed about 9% of the total revenues and 4% of the operating earnings in 2013.

Key drivers

The financial performance of the healthcare industry, represented by Healthcare Select Sector SPDR (XLV), depends on economic and labor conditions in its markets. The graph above shows that Nevada’s contribution to Universal Health Services’s total revenues declined from 17% in 2011 to 16% in 2013, whereas California’s contribution declined from 10% to 9% in the same period, reflecting the impact of weak economic conditions in these markets.

HCA Holdings (HCA), Community Health Systems (CYH), and Tenet Healthcare (THC) also suffered in their key markets—and especially in Florida—on account of a high unemployment rate and reduced spending capacity.