A brief overview of U.S. Bank

We’ll provide an overview of U.S. Bank. It’s the fifth largest retail bank in the US—by deposits and assets. At the end of September 2014, it held $391 billion in assets.

Nov. 20 2019, Updated 12:25 p.m. ET

An overview of U.S. Bank

In this part of the series, we’ll provide an overview of U.S. Bank. It’s the fifth largest retail bank in the US—by deposits and assets. At the end of September 2014, data indicated that U.S. Bank held $391 billion in assets. U.S. Bank’s holding company trades on the exchanges as U.S. Bancorp.

U.S. Bank (USB) provides commercial and consumer loans, deposits, and cards to its customers. It also provides mortgage banking, trust and investment management, and brokerage services.

Smaller than the big four banks

U.S. Bank is the largest bank outside of the big four banks. The big four banks are Wells Fargo (WFC), JPMorgan Chase (JPM), Bank of America (BAC), and Citibank (C). However, the gap between the big four and U.S. Bank is large.

U.S. bank is only nearly one-fourth the size of the smallest big four bank by assets—Wells Fargo. It’s nearly one-fifth the size of the largest big four bank by assets—JPMorgan Chase.

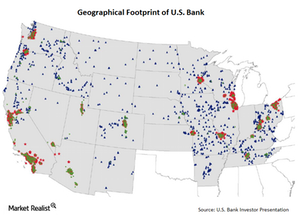

This huge difference in size has an impact on U.S. Bank’s ability to compete with the big four on all fronts. As a result, U.S. Bank chose to focus on a limited geographic area across the US. U.S. Bank is also an important part of the Financial Select Sector SPDR (XLF).

U.S. Bank isn’t present across the US

This strategy means that U.S. Bank (USB) isn’t present across the US. The bank focuses mainly on 25 states in the West and the Midwest. U.S. Bank caters to its clients through a network of 3,177 branches and 5,026 ATMs. U.S. Bank has many branches inside grocery stores.