Short-term effects of changes to Herbalife’s marketing plan

Pershing Square Capital Management commented on Herbalife’s marketing plan in its latest shareholder letter.

Nov. 27 2019, Updated 7:50 p.m. ET

Changes to Herbalife’s business model and marketing plan impact performance

William Ackman has alleged that Herbalife’s (HLF) multilevel marketing (or MLM) model is a fraud and a pyramid scheme. Some of Herbalife’s MLM peers such as Nu Skin Enterprises, Inc. (NUS), Mannatech, Inc. (MTEX), and Usana Health Sciences, Inc. (USNA) have also seen allegations that they are pyramid schemes. Other well-known MLM companies are Avon Products, Inc. (AVP), Tupperware Brands Corporation (TUP), and Amway. Our July article discusses Herbalife’s direct selling model in detail.

Pershing Square Capital Management commented on Herbalife’s marketing plan in its latest shareholder letter. It stated that Herbalife “announced numerous changes to its business model and marketing plan, a stark reversal from previous assertions that claimed that its business model is beyond reproach.” It further said, “Judging by the poor financial performance, it appears that even marginal changes in Herbalife’s business practices have made it materially more difficult for the company to attract new distributors and generate sales.”

New initiatives affect 3Q performance

Herbalife’s shares plunged after the announcement of its third-quarter earnings report in November. Its 3Q14 sales, earnings, and guidance came below estimates. Herbalife’s management acknowledged that certain changes to its business model have impacted the company’s performance for the short term.

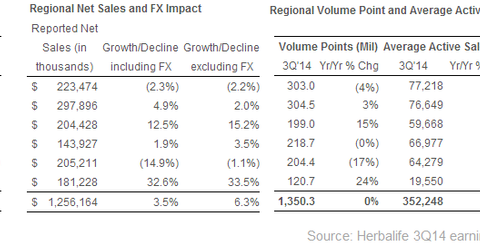

Sales for 3Q14 rose 4% to $1.26 billion, from $1.21 billion, but came below street estimates of $1.32 billion. Chairman and CEO Michael Johnson said in the earnings release that the initiatives being implemented will “drive long-term improvements in activity, productivity and retention.”

Initiatives emphasize gradual, controlled way of recruitment

Pershing Square noted in its letter, “While the number of Sales Leaders (distributors who have achieved certain minimum inventory purchases) increased (perhaps due in part to reduced qualification standards), the number of non-Sales Leader members (a leading indicator of future Sales Leaders) declined.”

Management noted on the earnings call that some of the changes include “standardizing the sales leader qualifications of 4,000 volume points over a 12 month period, having all members qualifying for sales leader ordering from the company, and limiting the size of new members first orders with the company.” They added that a gradual, controlled way of recruiting members has led to successful productivity and retention.

Herbalife’s North American sales fell 2.2% to $223.6 million. Sales declined 15% to $205.2 million in South and Central America. Excluding foreign exchange impact, sales declined only 1.1% in South and Central America. Further details on the segment performance can be found in the next part of this series.