Tupperware Brands Corp

Latest Tupperware Brands Corp News and Updates

Newell Brands Declares Dividend of $0.19 per Share

Newell Brands (NWL) reported 3Q16 net sales of $4.0 billion, a rise of 158.5% over the net sales of $1.5 billion in 3Q15, due to the acquisition of Jarden.

Why Is Newell Brands Selling Its Tool Business?

Newell Brands reported 2Q16 net sales of $3.9 billion—a rise of 143.8% compared to net sales of $1.6 billion in 2Q15.

Newell Brands Reaffirms Its Fiscal 2016 Projections

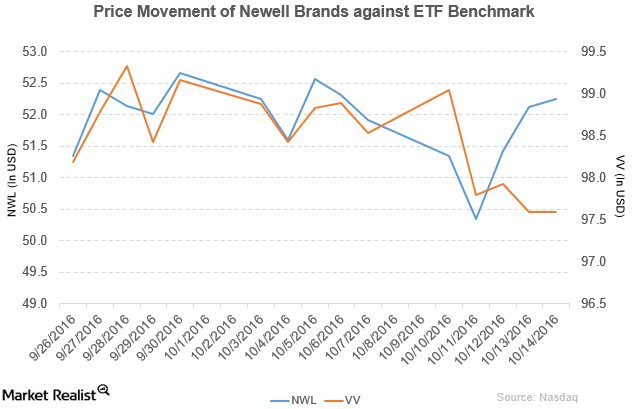

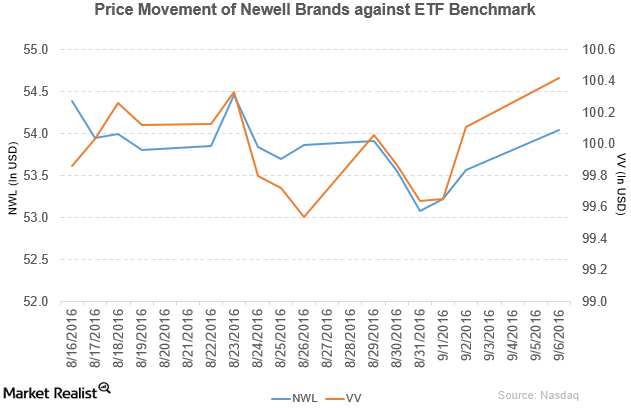

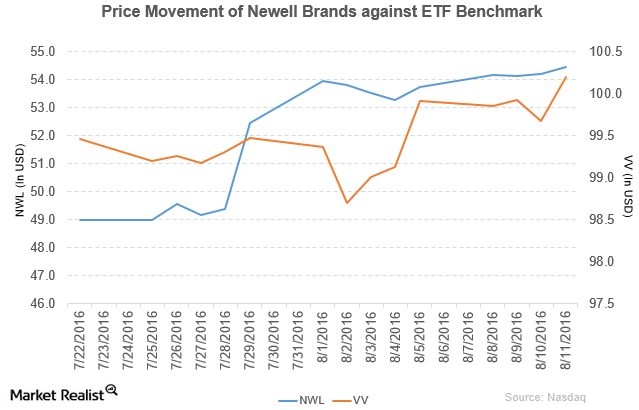

Newell Brands (NWL) has a market cap of $25.9 billion. It rose by 0.88% to close at $54.04 per share on September 6, 2016.

Newell Brands Plans Its Growth Strategies

In 2Q16, Newell Brands’s net income and earnings per share fell to $135.2 million and $0.30, respectively, compared with $148.5 million and $0.55, respectively, in 2Q15.

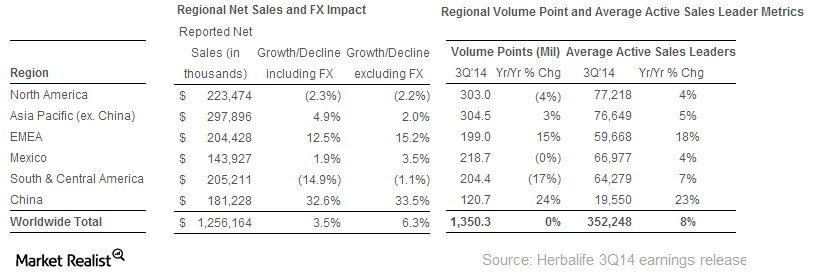

Short-term effects of changes to Herbalife’s marketing plan

Pershing Square Capital Management commented on Herbalife’s marketing plan in its latest shareholder letter.

Newell Brands Announces Its New Acquisition Plans

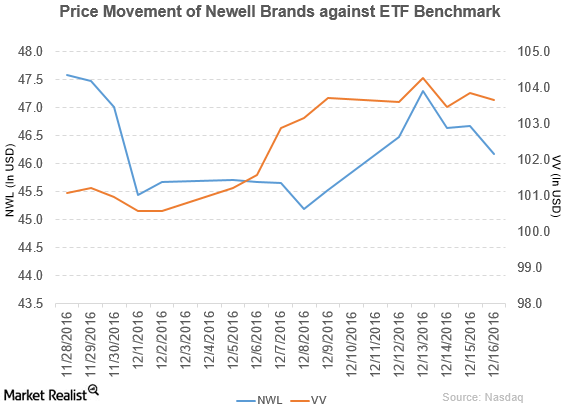

Price movement Newell Brands (NWL) rose 1.4% to close at $46.18 per share during the second week of December 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 1.4%, -1.2%, and 6.5%, respectively, as of December 16. NWL is trading 1.1% below its 20-day moving average, 5.0% below its 50-day moving average, […]

Raymond James Upgrades Newell Brands to ‘Strong Buy’

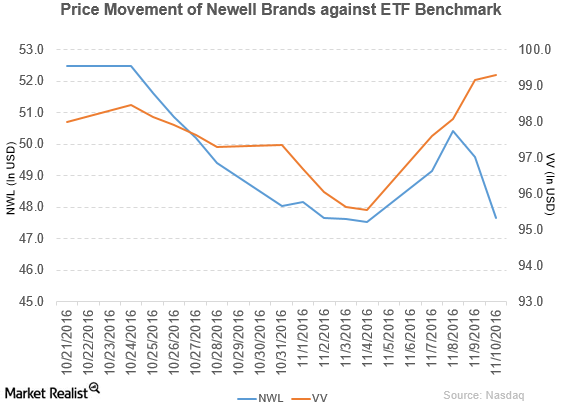

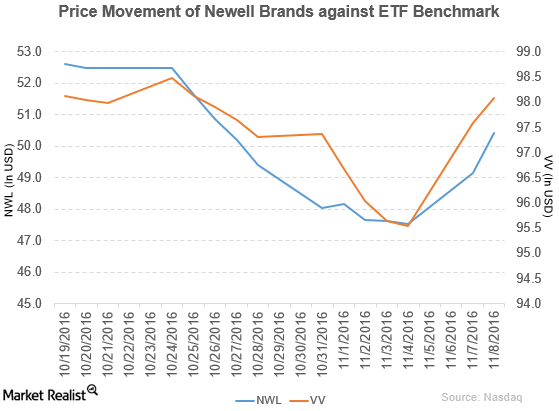

Price movement Newell Brands (NWL) has a market cap of $24.3 billion. It rose 2.5% to close at $50.41 per share on November 8, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 4.7%, -1.8%, and 15.8%, respectively, on the same day. NWL is trading 0.33% below its 20-day moving average, 2.1% […]

Newell Brands Declares Quarterly Dividend of $0.19 Per Share

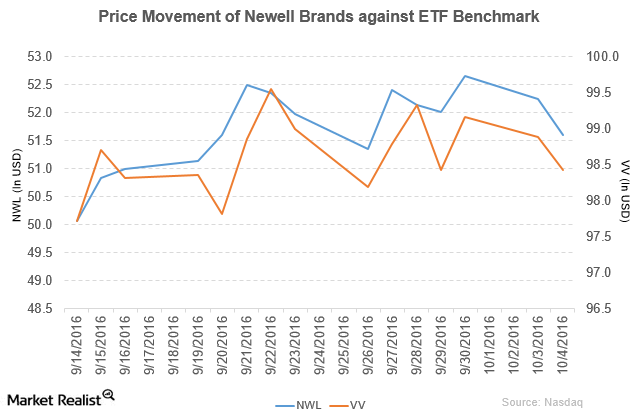

Newell Brands (NWL) has a market cap of $27.1 billion. It rose by 0.52% to close at $54.47 per share on August 11, 2016.

A Look at Newell Brands’ Performance in 2Q16

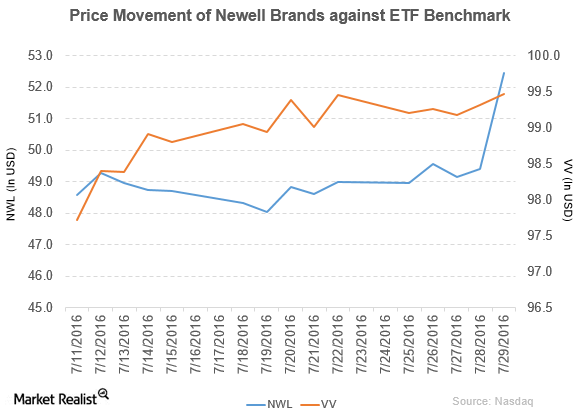

Newell Brands (NWL) has a market capitalization of $25.6 billion. It rose by 6.2% to close at $52.46 per share on July 29, 2016.

Newell Brands Sold Its Brands to Hunter Douglas

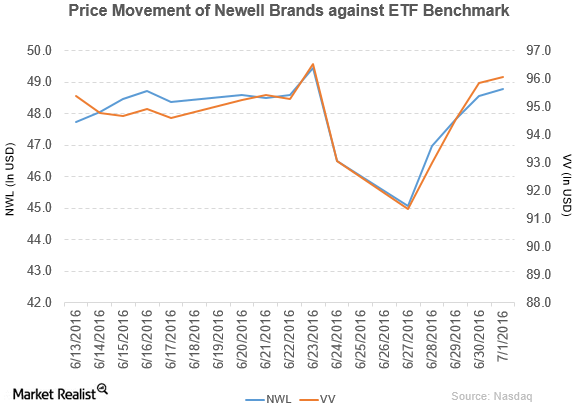

Newell Brands (NWL) has a market capitalization of $24.0 billion. It rose by 0.43% to close at $48.78 per share on July 1, 2016.

Tupperware Brands’ Revenue and Income Fell in 4Q15

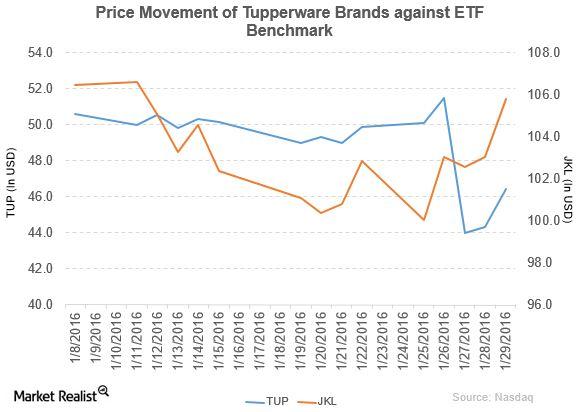

Tupperware Brands (TUP) fell by 6.9% to close at $46.43 per share at the end of the last week of January 2016.

Newell Rubbermaid–Jarden Deal: Strategic Rationale

Strategic rationale of the deal Both Newell Rubbermaid (NWL) and Jarden (JAH) are US-based consumer products conglomerates operating in diverse industries, with presences in several global markets. Both companies have strong portfolios of leading brands that are number one or number two in their categories. The combined company will have a concentrated portfolio of brands, […]Consumer Why Ackman targeted Herbalife’s nutrition clubs

Ackman has campaigned against Herbalife since December 2012. He has released numerous presentations and reports alleging the nutritional company’s multilevel marketing model is a fraud and a “pyramid scheme.”Consumer Must-know: An overview of Herbalife’s direct selling model

The founder and CEO of Pershing Square Capital Management, William Ackman, issued a presentation about global nutrition company Herbalife Ltd. (HLF).