Nu Skin Enterprises Inc

Latest Nu Skin Enterprises Inc News and Updates

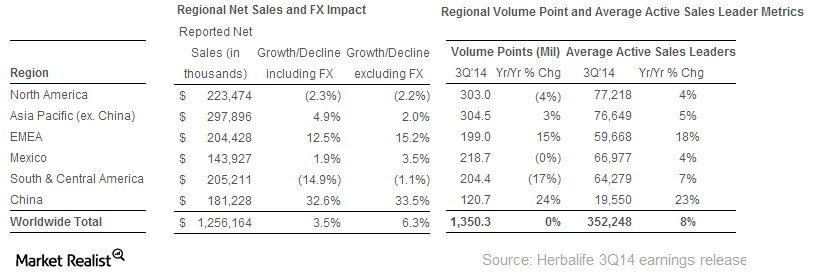

Short-term effects of changes to Herbalife’s marketing plan

Pershing Square Capital Management commented on Herbalife’s marketing plan in its latest shareholder letter.

Sidoti Upgrades Nu Skin Enterprises to ‘Buy’

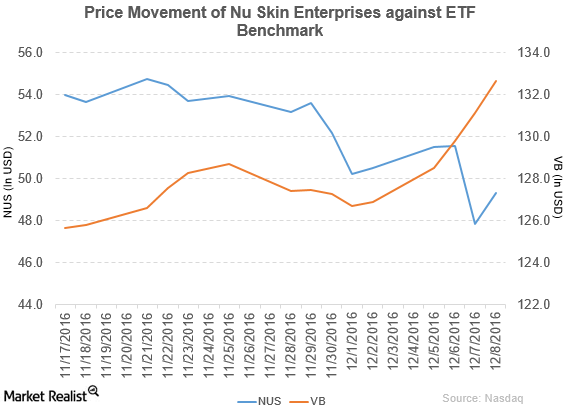

Price movement Nu Skin Enterprises (NUS) has a market cap of $2.7 billion. It rose 3.1% to close at $49.32 per share on December 8, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -1.8%, -7.9%, and 34.7%, respectively, on the same day. NUS is trading 6.3% below its 20-day moving average, […]

Nu Skin Enterprises Made Changes in Its Management

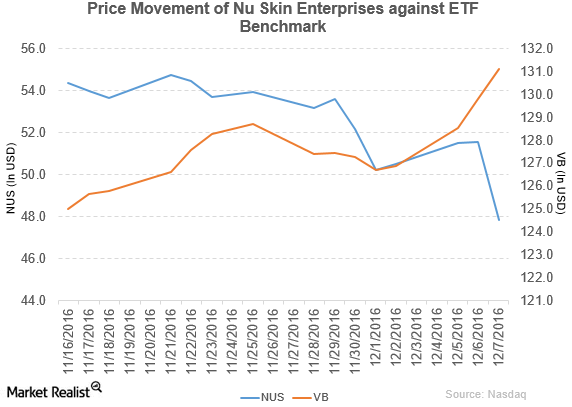

Nu Skin Enterprises (NUS) has a market cap of $2.6 billion. It fell 7.2% to close at $47.85 per share on December 7, 2016.

Nu Skin Enterprises Declares Its 3Q16 Results and Quarterly Dividend

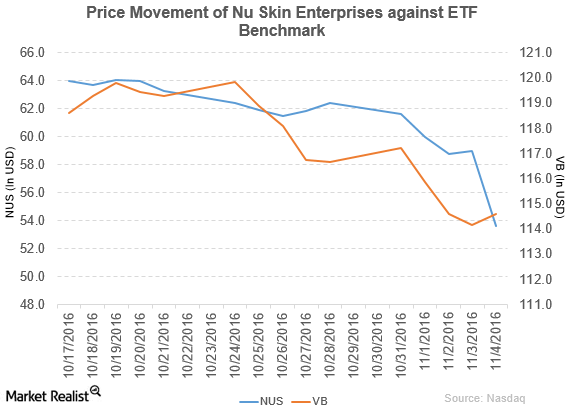

Nu Skin Enterprises (NUS) has a market cap of $3.0 billion. It fell by 9.1% to close at $53.61 per share on November 4, 2016.

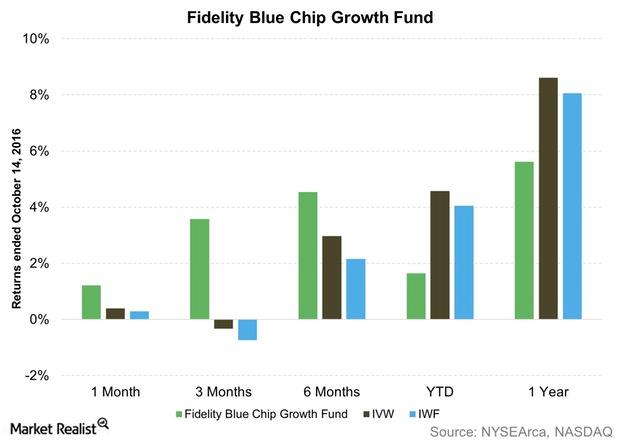

Behind the Fidelity Blue Chip Growth Fund’s Disappointing Performance in 2016

FBGRX has had a below-average 2016 so far, placing seventh in our select peer group of 12 funds in terms of point-to-point returns.

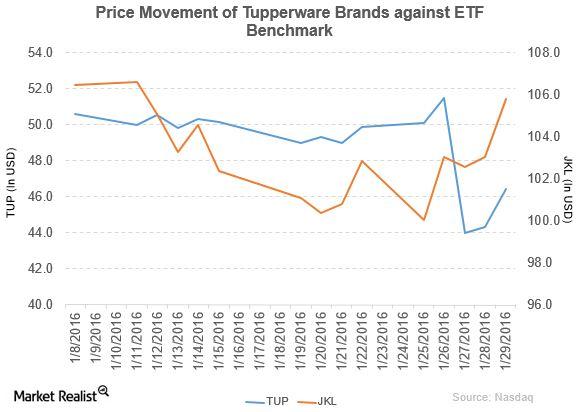

Tupperware Brands’ Revenue and Income Fell in 4Q15

Tupperware Brands (TUP) fell by 6.9% to close at $46.43 per share at the end of the last week of January 2016.Consumer Why Ackman targeted Herbalife’s nutrition clubs

Ackman has campaigned against Herbalife since December 2012. He has released numerous presentations and reports alleging the nutritional company’s multilevel marketing model is a fraud and a “pyramid scheme.”Consumer Must-know: An overview of Herbalife’s direct selling model

The founder and CEO of Pershing Square Capital Management, William Ackman, issued a presentation about global nutrition company Herbalife Ltd. (HLF).