Why downtrends and sideways trends impact investors

It’s advisable to sell stocks on bounces when the stock is in a downtrend. In a sideways trend, it’s advisable to buy stock at support levels and sell at resistance levels.

Nov. 27 2019, Updated 4:28 p.m. ET

Downtrend

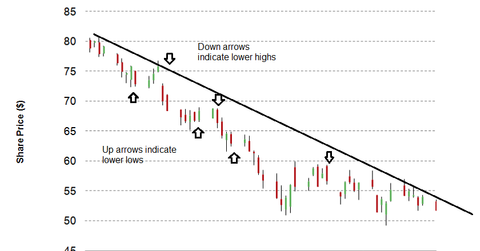

Stocks that are making lower highs and lower lows are in a downtrend. Lower highs mean the stock’s previous peak is higher than the current peak. Lower lows mean the current bottom is lower than the previous bottom.

The following chart shows the downtrend for Continental Resources Inc. (CLR).

A downtrend forms when psychological or fundamental factors are weakening. Depending on the source and duration of the driver, the downtrend may last as short as a few weeks to as long as a few years.

It’s advisable to sell stocks on bounces when the stock is in a downtrend. There’s pessimism in the market that the stock could decrease more. When the stocks are in a long-term downtrend, it’s called a bear market.

Sideways trend

Stocks that trade in a range are in a sideways trend. Stocks trading in a sideways trend trade between strong levels of support and resistance.

The following chart shows the sideways trend for a NASDAQ stock.

When stocks are in a sideways trend, the buying and selling pressure are almost at equilibrium. This is why the stocks trade in a range. A sideways trend may last as short as a few weeks to as long as a few years. The trend forms because there aren’t any psychological factors or fundamental news pushing the stock prices.

In a sideways trend, it’s advisable to buy stock at support levels and sell at resistance levels.