A must-know overview of Cheniere Energy

Cheniere Energy, Inc., is a Houston-based energy company engaged in the liquefied natural gas business.The Sabine Pass liquefaction project is one of the first projects to receive the necessary government permits to export liquefied natural gas.

Nov. 20 2020, Updated 5:00 p.m. ET

Cheniere Energy

Cheniere Energy, Inc. (LNG), or Cheniere-LNG, is a Houston-based energy company engaged in the liquefied natural gas, or LNG, business.

The company, through its ownership interest in Cheniere Energy Partners, L.P. (CQP), or Cheniere-CQP, owns and operates the Sabine Pass LNG terminal in Louisiana.

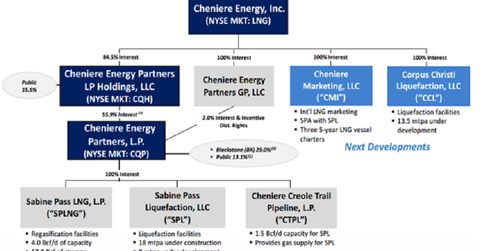

Cheniere’s organizational structure

Cheniere-CQP is a publicly traded master limited partnership that was created in 2007. Cheniere-LNG owns 100% of Cheniere-CQP’s general partner—Cheniere Energy Partners GP, LLC.

Also, Cheniere-LNG owns a 84.5% general-partner interest in Cheniere Energy Partners LP Holdings (CQH), a publicly traded, limited liability company formed in 2013. Cheniere-LNG also owns 100% of Cheniere Marketing and the Corpus Christi liquefaction project.

Important subsidiary

CQH holds a 55.9% interests in CQP. Plus, as noted in the chart above, ownership in Cheniere-CQP is shared between Blackstone and Cheniere-LNG. Blackstone holds 29% of Cheniere-CQP, while Cheniere-LNG has a 2% interest and incentive distribution rights. The rest of Cheniere Energy Partners is divided up among public shareholders.

Business segments

LNG terminal business – Cheniere-CQP’s Sabine Pass LNG terminal in Louisiana owns re-gasification facilities. Current facilities include five LNG storage tanks with a storage capacity of ~17 bcf, or billion cubic feet. It also has 5.3 billion cubic feet per day of pipeline interconnections.

The company is also planning a natural gas liquefaction and export facility—the Sabine Pass liquefaction project— at the Sabine Pass LNG terminal. We’ll look at this project later in the series.

Plus, Cheniere-LNG is planning a second natural gas liquefaction and export facility near Corpus Christi—the Corpus Christi liquefaction project. Provided the company gets the necessary regulatory approvals, Cheniere Partners expects to make a final investment decision in early 2015.

Cheniere also owns the Creole Trail Pipeline in Louisiana through its ownership in Cheniere Energy Partners.

LNG and natural gas marketing business – Cheniere energy operates this segment through its subsidiary, Cheniere Marketing, which is responsible for developing long and short-term and spot LNG sale and purchase agreements.

Key ETFs

Cheniere-LNG is a component of the Vanguard Total World Stock Market ETF (VT), Global X MLP & Energy Infrastructure ETF (MLPX), and the iShares Dow Jones US Energy Sector ETF (IYE).

The Sabine Pass liquefaction project is one of the first projects to receive the necessary government permits to export liquefied natural gas. The next part in our series discusses this unique opportunity in greater detail.

Check out Market Realist’s Energy & Power page for more articles on the energy industry.