Must-know: Why the Fed drove up emerging market asset prices

Many economists, like the Nobel Prize–winning Paul Krugman, believe that the Fed acted as a “white knight” in 2008, saving the global economy in the dire aftermath of the financial crisis.

Nov. 20 2020, Updated 5:23 p.m. ET

How the Fed drove up emerging market asset prices

Many economists, like the Nobel Prize–winning Paul Krugman, believe that the Fed acted as a “white knight” in 2008, saving the global economy in the dire aftermath of the financial crisis. While we give credit to Chairman Ben Bernanke for quickly responding to the contagion that spread after Lehman failed, his aggressive monetary policy didn’t need to stretch over five years.

What the U.S. really needed after QE1 were structural reforms to retrain the labor force and invest in education and infrastructure. To learn more about the Federal Reserve, click here.

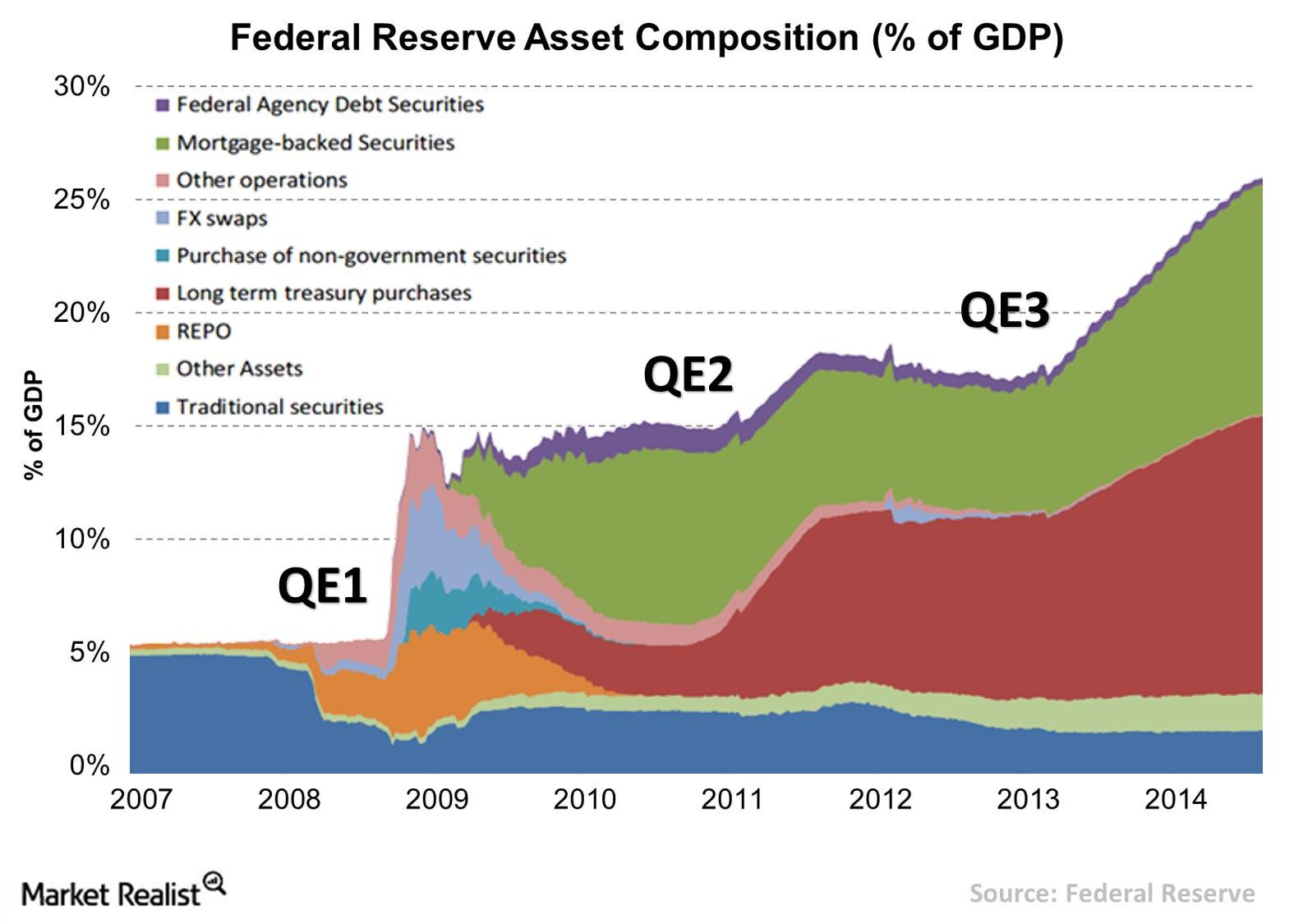

The graph below shows the asset composition of the Fed and the rapid ballooning of its balance sheet with each new round of quantitative easing from 2008 through 2014.

As you can see in the graph above, the Fed has been aggressively purchasing mortgage-backed securities (or MBS) and Treasuries since late 2008. Let’s try to understand how this action benefitted emerging market economies.

- As the Federal Reserve prints money, it effectively buys bonds and sells U.S. dollars (UUP) into the open market.

- The action of buying bonds indirectly lowers interest rates and results in a depreciation of the dollar as investors exchange the dollar for higher-yielding currencies and foreign bonds.

- Dollar depreciation is positive for commodity prices and commodity-driven emerging economies (EEM) since most commodities are priced in dollars. For example, to see the relationship between the dollar and gold (GLD) here.

- Most importantly, low interest rates are positive for foreign capital markets. They push fund flows into higher-risk assets, including foreign bonds and equities (VWO), as investors seek higher returns outside the U.S.

Since QE3 is ending this October, the corresponding rise in U.S. interest rates (TLT) and strengthening of the dollar may not bode well for foreign commodity-related exports and emerging market fund flows. We can summarize the simple logic behind this outlook with a hypothetical question. Would you purchase risky foreign bonds today, yielding 4%–6%, when the almost risk-free U.S. ten-year Treasury could yield 4% in the next one to two years?