Behind the Natural Gas Rig Count: Will Production Rise?

The natural gas rig count rose by four to 187 in the week ended September 8, 2017. On a YoY basis, the natural gas rig count more than doubled that week.

Nov. 20 2020, Updated 5:02 p.m. ET

The natural gas rig count

The natural gas rig count rose by four to 187 in the week ended September 8, 2017. On a YoY (year-over-year) basis, the natural gas rig count more than doubled that week, though natural gas (BOIL) futures have only risen 5.1% during this time period.

The oil rig count

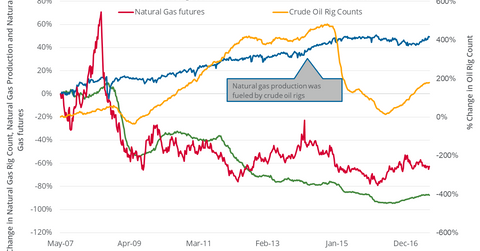

Between 2008 to date, natural gas supplies rose significantly. However, during this period, the natural gas rig count fell 88.6% from its record level in 2008.

The rise in the oil rig count could be responsible for the rise in natural gas supplies because often, natural gas is found during oil extraction.

Last week, the US oil rig count fell by three to 756. Moreover, the US oil rig count has shown a possible trend of sustained declines, which could cheer natural gas bulls.

However, there could be a 25% increase in new-well gas production per rig in September 2017, compared with the same period in the previous year, according to the EIA (US Energy Information Administration). Higher supplies could be a bearish catalyst for natural gas prices.

Based on their correlations with natural gas futures, US natural gas producers (XLE) (IEO) such as Southwestern Energy (SWN) and Gulfport Energy (GPOR) could be impacted by natural gas prices in the short term. Natural gas prices are important for these companies’ profitability in the long term.