How daily re-balancing affects returns on leveraged ETFs

Leveraged ETFs seek to provide a certain multiple (generally 2x or 3x) of daily returns on the underlying index. The daily movements in the underlying index and subsequent changes in ETF exposure may mean the ETF manager needs to rebalance the portfolio daily.

Nov. 26 2019, Updated 12:28 a.m. ET

Daily re-balancing affects returns on leveraged ETFs

Most leveraged (SSO) and inverse (SH) ETFs seek to generate a multiple of the benchmark (SPY) return for one day. As we discussed in the previous part of this series, the multiplier effect (in the case of leveraged ETFs) combined with the compounding may result in different multiple returns on a longer-term horizon, depending on the market.

Even if the fund generates 2x returns every day over a longer period, the holding period returns are unlikely to be a stated multiple of the benchmark (VOO). This reflects in the fact that while the average daily multiple return generated by SSO is close to 2x the returns generated by SPY in May 2014, SSO has generated a 4.58% return during the month, compared to 2.37% for SPY, at a multiple of 1.93x.

Why and how leveraged ETFs rebalance their portfolios

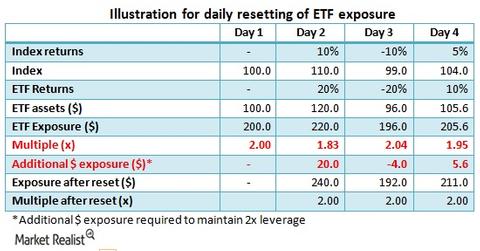

Leveraged ETFs seek to provide a certain multiple (generally 2x or 3x) of daily returns on the underlying index. The daily movements in the underlying index and subsequent changes in ETF exposure may mean the ETF manager needs to rebalance the portfolio daily. The following table will help you understand the concept of daily rebalancing (known as “resetting”) in greater detail.

Consider that both the underlying index and the ETF are at a level of 100 at the end of Day 1. On Day 2, the index rises 10%, leading to a 20% ($20) rise in the ETF’s value due to 2x leverage. The ETF exposure correspondingly increases by $20 to $220. However, as the ETF is now at 120, it requires exposure of another $20 to maintain 2x leverage. So, the fund managed takes additional exposure of $20 on the underlying index and starts Day 3 with an exposure of 2x. Without daily resetting, the returns on the ETF may vary from the stated goal of 2x daily returns, as the multiple before resetting is different from 2x, as you can see from the table above. Some funds, like the UBS E-TRACS 2x Monthly Leveraged Long Alerian MLP Infrastructure (MLPL), have a monthly reset schedule, meaning the exposure resets to 2x monthly.

While leveraged ETFs sounds like a lucrative bet in bull runs, a bull run itself is difficult to predict. In the next part of this series, we’ll cover the key drawbacks of investing in leveraged ETFs.