ProShares Short S&P500

Latest ProShares Short S&P500 News and Updates

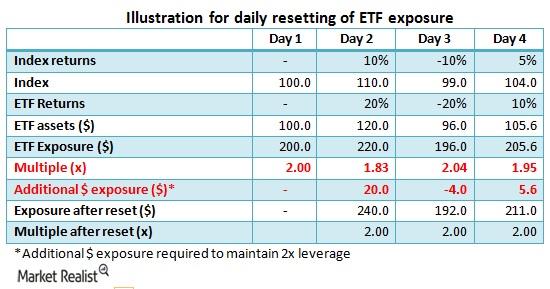

How daily re-balancing affects returns on leveraged ETFs

Leveraged ETFs seek to provide a certain multiple (generally 2x or 3x) of daily returns on the underlying index. The daily movements in the underlying index and subsequent changes in ETF exposure may mean the ETF manager needs to rebalance the portfolio daily.

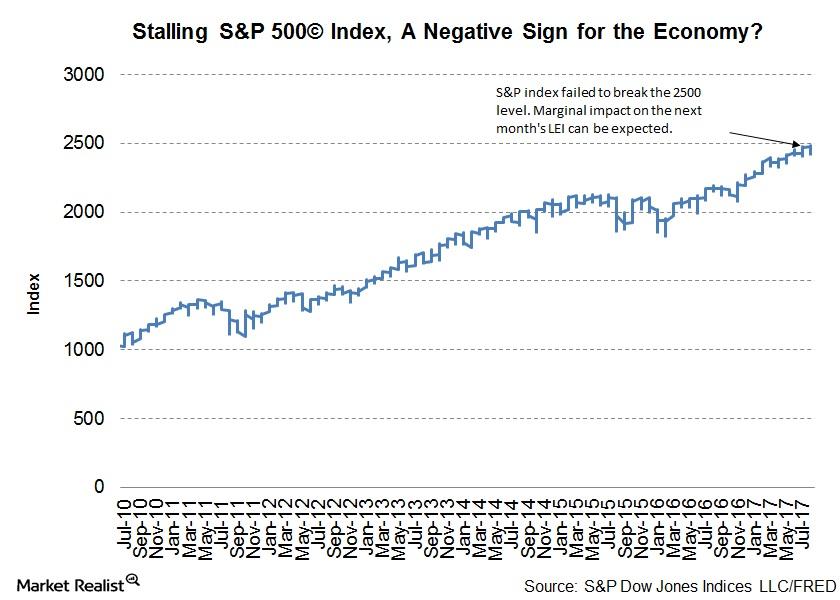

Could the S&P 500’s Stalled Ascent Derail Economic Expansion?

The risk scenario The S&P 500’s rally has stalled just shy of 2,500. Investors are drawn to to riskier assets such as equities when they expect further expansion in the economy. The S&P 500 (SPY), which comprises the 500 largest stocks in the United States, is a constituent of the Conference Board Leading Economic Index […]